RelayNode NYC #50 - April 27 - Cash rules everything around me, Singin' dollar dollar bill y'all

Welcome to RelayNode NYC Area edition! The NYC blockchain ecosystem is growing. Our goal is to harness its energy and innovation for the benefit of New Yorkers and provide a weekly curated list of interesting content, upcoming (virtual) events, and local jobs.

RelayNode Links: Sign up | Submit events

RelayNode NYC is curated by:

Founder @GogelX/Definancier, Advisor @Paperchain.io, fmr Associate @Techstars' Blockchain Accelerator, Co-president @Wharton FinTech, Corp Dev @LinkedIn @AIG

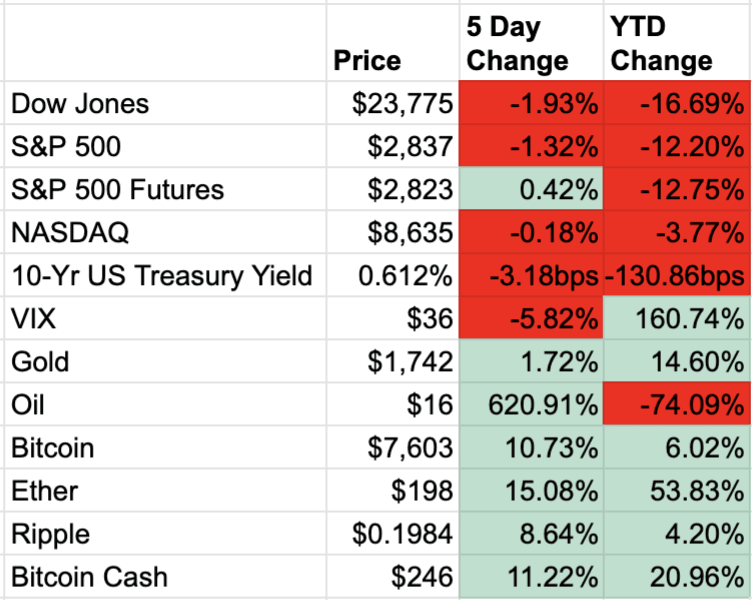

Market Stats (as of Sunday, April 26, 9:30 PM EST)

It’s strange to me that equity markets are only ~15% off all-time highs. Equity markets have consolidated while Q1 earnings season progresses, with 200+ companies already reporting. We are seeing a record level of 90% of companies deciding to provide no guidance. All the attention remains on COVID-19 developments against the backdrop of increasing efforts to re-open the economy. Busy week ahead for Macro, with the Fed, BOJ, and ECB due to announce policy decisions, and several major economies releasing GDP numbers.

COVID-19 has destroyed the demand for oil. Last week, the price of the main U.S. oil benchmark, West Texas Intermediate (WTI), fell more than $50 a barrel to about $30 below zero, the first time oil prices turned negative in history. Oil ETFs played a significant role in price dynamics.

It was another strong week in crypto markets with most assets enjoying price gains. The crypto markets have now fully retraced all losses from the "Black Thursday" plunge when bitcoin tumbled 39%. Bitcoin broke out of its range around $7,200 after finding some support in its 50-day MA. Ether is up more than 50% this year, partly due to continued USD stablecoin issuances.

1 Big Thing: (De)(In)flation & Dollar Strength

According to Neil Irwin in his op-ed for the New York Times,

“The broader takeaway is that the Covid-19 crisis is an extraordinary deflationary shock to the economy, causing the idling of a vast share of the world’s productive resources. Don’t let shortages of a few goods, like face masks or toilet paper, confuse the matter. The consequences will almost surely persist beyond the period of widespread lockdowns.”

Deflation occurs when the prices of goods and services decrease, while inflation occurs when those prices increase. The balance between these two economic conditions is delicate.

COVID-19 has released a number of deflationary pressures, including massive unemployment (16% in the US by this summer according to the CBO), decreasing GDP, and weak aggregate demand.

Some think deflation concerns are overdone since prices could increase as economic activity resumes and the impact of government and central bank stimulus kicks in, spurring demand. Further, large increases in fiscal deficits and central bank balance sheets tend to drive up prices.

Despite the Fed's best efforts to inject liquidity into the system, the dollar continues to strengthen as it (currently) retains its status as a global reserve currency, store of value, and safe haven. Ari Paul, Founder of BlockTower Capital, has a great tweetstorm explaining why he thinks we're likely to see a simultaneous increase in dollar usage globally and a piling into alternative currencies on a much smaller scale:

A very complicated topic being debated even by the most senior economists and seasoned investors: what does the world look like as we combine deflationary "dollarization" with massive money printing. This thread is an attempt at exploring the subject -

Go Deeper:

What To Read

🌐 Macro / Why Bitcoin?

🌐 Bloomberg released its Apil 2020 Crypto Outlook report. “This year marks a key test for Bitcoin's transition toward a quasi-currency like gold, and we expect it to pass. Unlike the stock-market reset but similar to gold's, Bitcoin had its shakeout, stabilizing the foundation amid unprecedented global monetary stimulus and increasing adoption... pricing resets for the primary quasi-currencies, and this year's shakeout in equities, support Bitcoin and gold-price appreciation, in our opinion.”

🌐 The next Bitcoin halving is ~15 days away: according to skew, the market is pricing in a small event for the BTC halving, but with implied volatility elevated relative to historical levels, it is not as pronounced in the implied volatility term structure.

💰 Funding, M&A, & Exits

💰Kava, a DeFi platform built on the Cosmos Network, on which users can leverage and hedge crypto, raised $750,000 from Framework Ventures, which purchased 3.89% of circulating supply of tokens. Kava is set to launch next month and will allow users to create collateralized debt positions on the Kava protocol in exchange for a stablecoin, USDX, pegged one-to-one with the USD.

💰Applied Blockchain, a London-based enterprise blockchain solutions firm, raised £2M (~$2.5M) in funding led by Hong Kong-based venture capital firm QBN Capital. Funds will be used to develop its privacy-focused platform to help companies improve the way they handle data.

💰tZERO, Overstock’s blockchain subsidiary, raised $5M in funding from GoldenSand Capital, a private equity firm based in Hong Kong. tZERO previously raised $134M via a STO to build out its security token trading platform. tZERO is aiming to launch a broker-dealer platform by June.

📦Product Launches

📦ETH futures contracts: BitMEX announced the launch of new ETH / USD futures contracts. The exchange will offer up to 50x leverage and will require margin posted in Bitcoin, allowing traders to long or short the ETH/USD exchange rate without touching either ETH or USD. The new futures should improve price discovery and liquidity in the spot market.

📦Decentralized perpetual contracts: dYdX, a non-custodial derivatives exchange, announced the launch of perpetual contract markets that enable the trading of any non-Ethereum based asset. The market is still in a private Alpha. The BTC-USDC Perpetual will offer 10x leverage on BTC (long or short) with no expiry, and settlement and margining in USDC. A periodic funding rate paid between longs and shorts keeps the contract price tethered to the underlying.

🔓 DeFi / OpFi

🔓Launch Fail & Security Audits: Hegic, an on-chain options trading protocol on Ethereum, announced the v1 launch of its options protocol, allowing anyone to buy and sell American call/put options. Shortly after launch, the team found a typo in its smart contracts locking up user funds (liquidity in expired options contracts can’t be unlocked for new options.) An April security audit from Tail of Bits shows that this vulnerability was known beforehand. MyCrypto reviews the code audit summary.

🔓The rise of DeFi middleware: Zerion released its DeFi SDK, an open-source system of smart contracts designed for accounting across multiple protocols and dApps. This makes it easier for teams to integrate on-chain data and reduce the inefficiencies surrounding DeFi accounting.

🔓Constant Function Market Makers: Dmitriy Berenzon, Research Partner at Bollinger Investment Group, reviews the difference between automated market makers and constant function market makers. He then explores the pros & cons of constant function market makers and discusses future directions of CFMM designs and use-cases. Fascinating read.

🔓The beginning of social payments: Dharma launched a new product called Social Payments allowing Twitter users to accept digital payments in US dollars. Users receive tips and micropayments easily and without fees. Money stored in its wallet earns a 3.6% APR.

🔓A signed price feed available via the Coinbase Pro API: Coinbase announced a new Coinbase Price Oracle that enables anyone to use their API to get signed price data for BTC-USD and ETH-USD. It also allows anyone to verify the authenticity of the data and publish themselves using the Coinbase Price Oracle public key.

🔓Hack happy ending: The dForce attacker returned the $25M worth of stolen funds back project. Camila Russo, Founder at The Defiant, breaks down the hack. Despite the happy ending, the incident highlights the needs for better security.

🔓Maker Protocol Changes: The Maker token holders approved the following alterations to the protocol: lower the USDC Stability Fee from 8% to 6%, lower the USDC Liquidation Ratio from 125% to 120%, whitelist Set Protocol on ETH/USD Oracle, create BTC/USD Oracle + Whitelist Set Protocol and dYdX, create ETH/BTC Oracle + Whitelist BTC, deactivate the MKR Oracle in SCD, raise the Governance Security Module delay from 4 hours to 12 hours, raise the DAI Debt Ceiling from 90M to 100M.

💸 STOs / Stablecoins / Tokens / DAOs

💸Stablecoins have grown by nearly $3B, now reaching $9B: Coinbase describes the current stablecoin landscape and their ability to encourage liquidity, facilitate transactions and act as collateral. Growth is likely to increase driven by both transaction demand and surging demand for dollars.

💸Stablecoins issuance impact: Researchers with the University of California Berkeley’s Haas Blockchain Initiative found stablecoin issuances do not have an inflationary effect on crypto asset prices. Rather, evidence supports alternative views, namely, that stablecoin issuance endogenously responds to deviations of the secondary market rate from the pegged rate, and stablecoins consistently perform a safe-haven role in the digital economy.

🌉 Infrastructure

🌉Step forward for secure, compliant P2P transactions of digital securities: Securitize, the tokenized security issuance platform, launched a new peer-to-peer trading product named Instant Access in partnership with Airswap. Investors can buy or sell DS Protocol-powered security tokens in seconds without counter-party risk or intermediated trading fees.

🌉Regulated crypto derivatives market heating up: Bitnomial, a crypto exchange offering list-margined and physically delivered Bitcoin futures and options contracts, received approval from the CFTC to operate as a designated contract market (DCM). Bitnomial raised $7.5M in an equity raise December 2019.

🌉Exchange localization: Binance announced the launch of Bundle, its social payments app providing users across Africa with a fee-free means to store and transact in both cash and crypto, through a new digital wallet.

🍰Layer 1

🍰NEAR Protocol’s road to mainnet: NEAR Protocol, a PoS smart contract platform with a focus on high performance, announced its POA mainnet has launched, with 2 more releases set over the next few months.

🍰The Stacks 2.0 testnet: Blockstack PBC, the company building core protocols for Blockstack, launched the Stacks 2.0 Testnet. This testnet will allow developers and miners to participate in the deployment of Blockstack’s new consensus mechanism, dubbed Proof of Transfer (PoX).

🎧 Podcast of the Week

🎧Wharton FinTech interview with Nitai Bran, CEO, and John Todaro, Director of Research of Tradeblock

Upcoming Virtual Events / Conferences

April 28: Web3 Sub0 Online - A Substrate Developer Community Conference (Virtual)

April 30: Wave Financial: Digital Asset Perspectives (Virtual)

May 1-2: DeFi Discussions Conf (Virtual)

May 4-6: Ready Layer One (Virtual)

May 7-8: Ethereal Virtual Summit 2020 (Virtual)

May 11-15: Consensus 2020 (Virtual)

June 1-3: The Mainnet by Messari (Virtual)

June 24-26: Remote Crypto Con (Virtual)

June 15-21: Korea Blockchain Week (Seoul)

July 6-7: M2 Asset Management (Oxford)

July 15-16: Asia Blockchain Summit (Taipei)

July 22-23: Mining Disrupt (Miami)

Sep 11-16: Shanghai Blockchain Week by Wanxiang Blockchain (Shanghai)

Sep 28-30: Hong Kong Blockchain Week 2020

October 7-8: Token2049 (Hong Kong)

Q3 (tbd): Bitcoin2020 (San Francisco)

🎓Highlighted Industry Jobs (non-exhaustive list for NY)

If you would like to highlight jobs or internships in future editions, please email links here.

Gemini - Head of Data / Various

BlockFi - Product Manager

Bakkt - Various Engineering

Elementus - Developer

Axoni - Director, Enterprise Solutions

LedgerX - VP of Finance

Chainlink - Developer Evangelist

Paxos - Various

Ripple - Various

ConsenSys - Various

Pantera Portfolio Co - Various

Chainalysis - Various

Messari - Various

ConsenSys Labs - Various

R3 - Various

Coin Metrics - Data Scientist

UMA - Various

Bison Trails - Various

BlockFi - Institutional S&T Associate

Republic - Biz Ops Associate Tokenization

According to LinkedIn, “blockchain” tops the list of most in-demand hard skills for 2020

Check out Cryptocurrency Jobs’ state of the hiring market report

Nothing written in RelayNode NYC is legal or investment advice and should not be taken as such. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.