RelayNode NYC #56 - Breaking through Invisible Asymptotes with Real-Word Assets on Ethereum.

Welcome to RelayNode NYC Area edition! The NYC blockchain ecosystem is growing. Our goal is to harness its energy & innovation for the benefit of New Yorkers, & provide a weekly curated list of personal thoughts, interesting content, upcoming (virtual) events, and jobs.

RelayNode Links: Sign up | Submit events | Submit jobs

I spent last week listening, learning, and protesting. I want to unequivocally say that #BlackLivesMatter.

RelayNode NYC is curated by:

David Gogel: Founder @GogelX/Definancier, Advisor/Operator/Investor, Advisor @Paperchain.io, Wharton MBA/BS/BA, fmr Associate @Techstars' Blockchain Accelerator, Co-president @Wharton FinTech, Corp Dev @LinkedIn @AIG

Follow me on: Twitter | LinkedIn | Definancier | 🙏 Please DM any feedback 🙏

Market Stats (as of Sunday, June 7th, 11:30 PM EST)

Global equity markets continue to rally, bringing the cumulative rally to ~37% since March 23rd lows. Last week, equity markets posted strong gains, driven by the prospect for a V-shaped recovery, a recovering IPO market, and a better-than-expected May jobs report. Friday’s report showed a surprise 2.5M increase in May payrolls (vs. 7.25M loss consensus). The headline unemployment rate also declined from 14.7% to 13.3% (vs. 19% consensus). Over the course of the week, the Dow, S&P 500, and NASDAQ gained 6.8%, 4.9%, and 3.4%, respectively.

Last week, the ECB and BOJ expanded asset purchase programs by ~$1.5T. The Fed has served as a backstop for Treasuries as capital outflows in EM sparked a decline in foreign Treasury holdings. The yield on the 10-yr Treasury rose 24 basis points, indicating that investors are expecting growth and inflation. This week, traders will be focused on the Fed’s policy statement and its first set of economic projections since December. Despite the risk-on environment, the risks of a solvency crisis, polarization through the November election, and more COVID infections related to protests remain on my mind.

The total market cap of crypto-assets sits at ~$277B, increasing 3% WoW. The price of bitcoin increased 8% on Monday to $10,200, a 3-month high, before falling back to about $9,400 on Tuesday. This was Bitcoin’s third time testing the $10,000 psychological level which has become a multi-year resistance. On BitMEX, total buy liquidations were $131M while sell liquidations were $111M. On a more positive note, according to data from skew, the CME had a strong trading session with bitcoin futures trading ~$800M. Options activity also continues to see good momentum with Jul20 calls trading in size. OI and volume put / call ratio near one-year lows indicating focus is mostly on upside.

1 Big Thing: Revisiting MakerDAO’s dual mandate: stablecoin vs. generalized lending protocol

"Credit is the most important part of the economy, and probably the least understood."

- Ray Dalio

MakerDAO is a Decentralized Autonomous Organization that manages the Dai Stablecoin System on Ethereum. It is the world’s first 100% software-based, community-owned and operated credit facility. As a family of smart contracts operating on Ethereum, the system offers secured loans of equal cost to anyone in the world. The by-product of loan generation is Dai, a stablecoin collateralized using on-chain rules and assets. Dai is pegged to US$1 and is maintained through automatic pricing mechanisms built into smart contracts.

In December 2017, Maker launched the Collateral Debt Protocol (CDP), enabling the creation of Dai, which has become a foundational lego block in DeFi. Anyone anywhere could open a CDP, lock ETH as collateral, and generate Dai as debt against that collateral. Only by driving the cost of manufacturing credit closer to $0 can a meaningful next-generation distribution and user experience layer be built. According to loanscan.io, Maker has since originated ~$2.4B (!!!) in loans. For some perspective, it took Lending Club 5 years to originate $250M in loans.

In Nov 2019, Maker introduced the Dai Savings Rate (DSR) and Multi-Collateral Dai (MCD), enabling new types of collateral to be used to create Dai. Since then, in addition to ETH, 3 new types of collateral have been added to MCD including BAT, USDC, and WBTC.

New Collateral Type

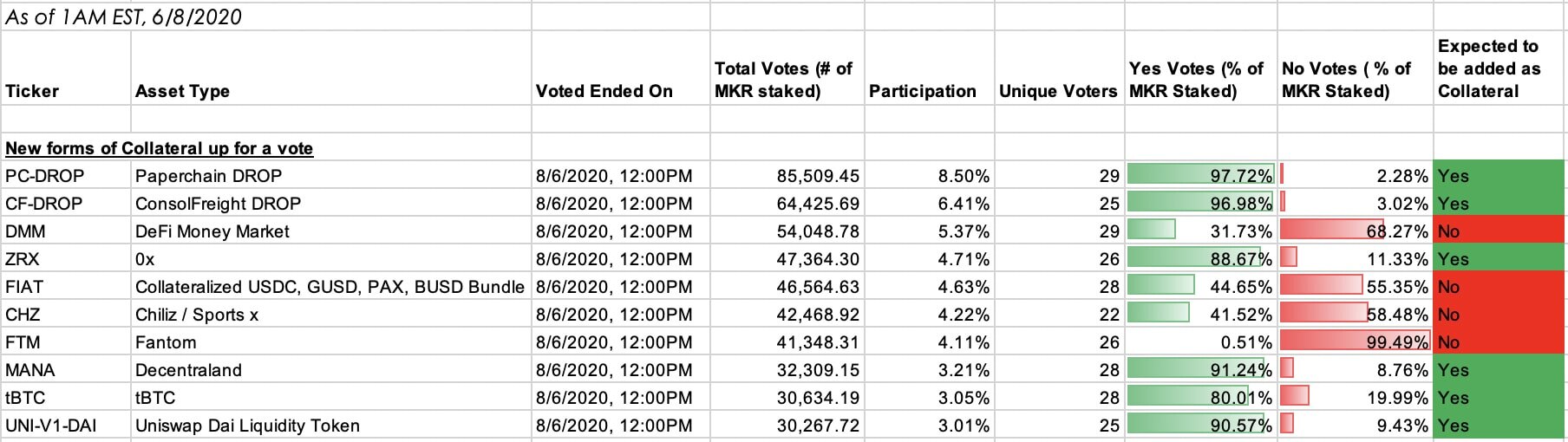

MKR token holders are currently in the final hours of voting on whether to further diversify the collateral the system accepts for loans to include new tokens and real-world assets.

Latest stats of voting polls, which close *today* at 12PM EST… note Paperchain currently has the highest # of MKR staked in favor of adding its token as a form of collateral (MIP6 application here.)

Step towards an open financial system & faster payments in the media industry.

So what does adding real-world assets as collateral in MCD look like? In October, I worked with the Paperchain team, Centrifuge, and the Maker Foundation to launch a pilot advancing $60K of earned but unpaid Spotify streaming revenue to an independent record label. It was the first collateralization and advance of its kind in the DeFi ecosystem. This post-mortem document describes the process of tokenizing synthetic account receivables to issue short-term secured loans. The loans are originated by Paperchain, with the intention of being used as collateral in MCD system through integration with the Tinlake system developed by Centrifuge. The pilot provides a roadmap for companies to tokenize real-world assets and pledge them as collateral in DeFi apps, enabling industry participants to access credit from a fully open and permissioned financial system run by smart contracts.

Enter Centrifuge TIN and DROP

Since the initial pilot, Centrifuge and Paperchain have been working closely with the Maker Foundation to build the tools to responsibly bridge real-world assets to the DeFi ecosystem.

Centrifuge recently announced the release of an open-sourced asset-backed lending dApp called Tinlake and the availability of the Centrifuge Chain on mainnet. Centrifuge Chain is a proof-of-stake blockchain built with Parity Technologies’ Substrate framework. NFTs representing real-world assets are pooled together and two sets of ERC20 tokens are issued against them, TIN and DROP. TIN takes the risk of default first but also receives higher returns. DROP is protected against defaults by the TIN token and receives stable and lower returns. Investors can purchase TIN and DROP tokens with Dai or USDC. The user who put up the collateral takes the stablecoins used to buy TIN and DROP as a loan. TIN and DROP holders receive interest asset holders pay for their loan.

Adding tokenized real-world assets as collateral for Dai is key for its long term stability and adoption as it addresses the two main challenges the DeFi ecosystem is currently facing: stability and volume. Indeed, many applications require a low threshold of volatility to be viable on a blockchain, and greater diversification of collateral types will increase stability. Further, limiting collateral types to crypto-natives assets limits the total addressable market of the overall system. DeFi can be used beyond speculative trading and to solve a real-world use case as an efficient mechanism for SME trade finance and payments.

Underwriting Risks

Nevertheless, risks remain. Mindao Yang, Founder of dforce, has a great tweetstorm:

https://twitter.com/mindaoyang/status/1268762450611978240

Go Deeper:

Lucas Vogelsang: Introducing Decentralized Asset Finance: Onboarding the World to DeFi

CoinDesk: MakerDAO Weighs Accepting Real-World Assets as Crypto Loan Collateral

Jason Choi: The Next 10 Years for MakerDao: A Conversation with Rune Christensen

What To Read

🌐 MACRO / WHY BITCOIN?

🌐 Bloomberg bull case for Bitcoin: Mike McGlone, a BI Senior Commodity Strategist at Bloomberg, makes a bull case for Bitcoin. “Bitcoin is mirroring the 2016 return to its previous peak. That was the last time supply was halved, and the third year after a significant peak. Our graphic depicts Bitcoin marking time for a third year following the parabolic 2017 rally. After 2014's 60% decline, by the end of 2016 the crypto about matched the 2013 peak. Fast forward four years and the second year after the almost 75% decline in 2018, Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016's trend.”

🌐 A critique of BitMEX: the team at Amun makes the case that BitMEX, one of most popular ways for traders to get leveraged exposure is inadequate and, more importantly, causes distinct negative externalities to the industry as a whole.

💰 FUNDING, M&A, EXITS

💰 Avanti, slated to be the first crypto bank based in Wyoming to be approved as a Special Purpose Depository Institution, raised a $5M angel round led by the University of Wyoming Foundation with participation from Morgan Creek Digital, Blockchain Capital, DCG, Lemniscap, and Madison Paige Ventures. Funds will be used for the application process with the Wyoming Division of Banking. Caitlin Long announced that the bank is aiming to open in early 2021.

💰 Numerai, a hedge-fund that crowdsources the distributed development of trading algos via competitions and provides an information marketplace, raised $3M via a token sale led by Union Square Ventures and Placeholder, with participation from CoinFund, Dragonfly Capital and Numerai founder Richard Craib. Funds will be used to develop Erasure, an information staking protocol.

💰 SynchroLife, a Japan-based restaurant review platform rewarding users in its native crypto token SynchroCoin for posting reviews and as cashback when dining at participating restaurants, raised $2.6M in Series A funding led by MTG Ventures, with participation from Giftee, Orient Corporation, Ceres, Sansei Capital Investment, and Mitsubishi UFJ Capital, among others.

🔓 DEFI / CEFI / OPFI

🔓 DeFi's Invisible Asymptotes: While DeFi reached $1B+ milestone (again) in Total Value Locked, Kyle Samani, GP at Multicoin Capital, expresses his concerns that the DeFi economy is hitting its growth limits. He assesses the strengths and weaknesses of the current DeFi regime against CeFi (centralized finance) and invisible asymptotes (latency, throughput).

🔓 Compound’s $COMP distribution design incentivizes phantom growth: Henry He, Founder @SesameOpen, argues that $COMP distribution is an effective incentive design to drive fast growth of Compound’s protocol. Compound boosts its crypto lending platform with “negative borrowing rate with positive high lending rate”, which will inevitably lead to phantom growth.

🔓 DeversiFi 2.0 brings high-speed decentralizing trading: DeversiFi, a professional-grade, self-custodial exchange, launched an upgrade integrating StarkWare’s zkSTARK technology, which enables the decentralized exchange to process thousands of transactions per second. StarkWare’s batching technology. DeversiFi can now settle 9000+ trades per second via UI or API.

🔓 More Collateral Types added to Maker: MKR holders have accepted TUSD (TrueUSD) and USDC-B (the USDC token with different risk parameters) as new collateral assets in the Maker Protocol.

💱 STABLECOINS & CBDCs

💱 CBDCs could disrupt commercial banks: The introduction of CBDCs allows central banks to engage in large-scale intermediation by competing with private financial intermediaries for deposits. The Philadelphia Fed examines account-based CBDCs, suggesting they could potentially replace commercial banks.

🌉 INFRASTRUCTURE

🌉 Increasing adoption of the Brave browser: Brave combines privacy with a blockchain-based digital advertising platform and offers 3-6x faster browsing than other browsers. Brave announced it passed 15M monthly active users and 5M daily active users, showing 2.25x MAU growth in the past year.

🌉 Decentralizing LIBOR: Jerome Powell, the Fed Chairman, provided a statement regarding the suitability of AMERIBOR, which uses a permissioned version of Ethereum to capture interbank lending rates, as a replacement to LIBOR. AMERIBOR (American Interbank Offered Rate), disseminated by the American Financial Exchange (AFX), is a transparent, transaction-based interest rate benchmark that represents market-based borrowing costs.

🌉 Institutional transfers redefining on-chain settlement processes: Fireblocks, an enterprise-grade platform delivering a secure infrastructure for moving, storing, and issuing digital assets, announced the launch of the "Asset Transfer Network" for institutions. Users are able to find and connect with financial institutions and exchanges – in order to safely and securely transfer assets on-chain and without taking counterparty risk to Fireblocks. 55 institutions and 26 exchanges are already active on the Network.

🍰 LAYER 1

🍰 Improving Ethereum fundamentals: TradeBlock analyzes improving Ethereum transactional activity (daily gas usage hits highs, stablecoin demand grows significantly), in comparison to the price of Ether.

🔓 Dharma open-sources Optimistic Rollups Layer 2 implementation: After announcing its intention to build a Layer 2 scalability system for supporting P2P payments on Ethereum, Dharma partnered with Interstate to develop an open-source implementation of Optimistic Rollups called Tiramisu.

🍰🍰 LAYER 2

🍰🍰 Scaling Ethereum via ZK-Rollups: StarkWare announced that using StarkEx, a ZK-Rollup, the team trustlessly onboarded to Ethereum Mainnet 1.3M accounts with initial balances, effectively demonstrating how an entire subreddit the size of r/FortNiteBR (with its Brick tokens) could be brought onto Mainnet.

🍰🍰 Scaling Ethereum via Plasma: OMG Network, formerly known as OmiseGo, deployed an implementation of Plasma, a Layer 2 scaling solution, on the Ethereum mainnet. Bitfinex announced it will integrate its Tether stablecoin with the OMG Network, promising cheaper transactions as Ethereum’s fees skyrocket. According to ETH Gas Station, Tether is the largest gas guzzler on Ethereum with ~$2.2M in fees spent in the last 30 days.

⚖️ LEGAL

⚖️ OCC signals change to digital banking rules: The OCC, the US regulator with a national charter for banks, announced it is examining its digital banking regulations and seeking public input. Of particular note, the OCC is seeking input on: “what activities related to cryptocurrencies or cryptoassets are financial services companies or bank customers engaged in and what are the barriers or obstacles to further adoption of crypto-related activities in the banking industry… how is distributed ledger technology used or potentially used in activities related to banking.” The notice comes shortly after the appointment of Brian Brooks, former Coinbase Chief Legal Officer, as acting head of the OCC.

🎥 VIDEOS OF THE WEEK

📅 Upcoming Events / Conferences

June 8-10: CogX (Virtual)

June 10: Lending and Reducing Risk on Blockchains (Virtual)

June 11: A Review of Fidelity's Annual Institutional Investor Survey w/ Dan Morehead (CEO, Pantera Capital) (Virtual)

June 24-26: Remote Crypto Con (Virtual)

June 15-21: Korea Blockchain Week (Seoul)

July 6-7: M2 Asset Management (Oxford)

July 15-16: Asia Blockchain Summit (Taipei)

July 21-23: Singapore Blockchain Week (Virtual)

July 22-23: Mining Disrupt (Miami)

🎓Highlighted Industry Jobs (non-exhaustive list for NY)

If you would like to highlight jobs or internships in future editions, please email links here.

Open Roles in Engineering, Product, Sales & Marketing, Operations:

Chainalysis - Principal Security Engineer (new)

Columbia University - Adjunct Associate Faculty, Intro to Blockchain, Cryptocurrencies & Analytics (new)

Genesis Global Trading - Operations Analysis

BlockWorks Group - Account Executive

Streamr - Head of Developer Relations

Staked - Sales Development Representative

3Box - Senior Software Engineer / Full Stack / Backend Engineer

Gemini - Technical Operations SRE Lead

BlockFi - Trading Developer / Product Manager

Transak - Full Stack Engineer

Nothing written in RelayNode NYC is legal or investment advice and should not be taken as such. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.