RelayNode NYC #54 - Freedom isn't free.

Welcome to RelayNode NYC Area edition! The NYC blockchain ecosystem is growing. Our goal is to harness its energy & innovation for the benefit of New Yorkers, & provide a weekly curated list of personal thoughts, interesting content, upcoming (virtual) events, and jobs.

RelayNode Links: Sign up | Submit events | Submit jobs

RelayNode NYC is curated by:

David Gogel: Founder @GogelX/Definancier, Advisor/Operator/Investor, Advisor @Paperchain.io, Wharton MBA/BS/BA, fmr Associate @Techstars' Blockchain Accelerator, Co-president @Wharton FinTech, Corp Dev @LinkedIn @AIG

Follow me on: Twitter | LinkedIn | Definancier | 🙏 Please DM any feedback 🙏

Market Stats (as of Monday, May 25th, 11:55 PM EST)

I hope everyone had a chance to decompress a little and enjoy the Memorial Day long weekend, honoring the men and women who died while serving.

US equities rallied last week, with the Dow, S&P 500, and NASDAQ increasing 3.3%, 3.2%, and 1.8%, respectively. Most of the gains came on Monday following comments from the Fed Chairman and positive news on a potential vaccine. Overlooking ~40M newly unemployed, the markets remain “satisfied” with the reopening efforts taking place in all 50 states and the policy support from the Fed and Congress. As the Fed continues to boost credit markets, corporate America is gorging on debt. However, the liquidity crisis is quickly turning into a solvency crisis, forcing companies like JCrew, JCPenney, and Hertz to file for bankruptcy. Further, macro risks are rising as China proposed new security laws in Hong Kong. Looking ahead, traders will focus on US GDP numbers and job figures.

Crypto markets are once again decoupling from equities. The total market cap of all cryptoassets sits at $250B, down -5% WoW. Bitcoin declined ~8.2% partly due to fears around an early miner selling 2009 coins and BitMEX unscheduled maintenance, compounding the retrace from $10k. Options show an increase in BTC put positions indicating investors may be expecting further downside.

1 Big Thing: Measuring Institutional Adoption

TL;DR: Crypto has been uniquely retail-driven. A common recurring narrative is that “institutions are coming.” PJT’s entry was a watershed moment. I spent some time exploring metrics to quantitatively evaluate institutional adoption. Data confirms May was an inflection point.

Assets Under Management / Inflows into $GBTC

Grayscale now has ~$3.6B in AUM. ~89% of the assets held are in Bitcoin. The firm added $1B to its crypto funds in under a year. Its products are exchange-traded vehicles backed with crypto, with ~90% of its inflows coming from institutions. While initial shares are only available to accredited investors, secondary trading is open to any investor.

Grayscale’s Bitcoin Trust shares (GBTC) are currently trading at $10.66 per share, a 21.63% premium over NAV. Institutions are willing to pay a 2% management fee to not deal with custody.

CME bitcoin futures volume / open interest (OI)

The CME launched cash-settled bitcoin futures in 2017 due to "increasing client interest." In May, OI reached an all-time high of $532M, indicating institutional money is flowing in. Daily volume peaked at $914M on May 11 but remains muted compared to highs in February. The next CME Bitcoin futures expire this Friday.

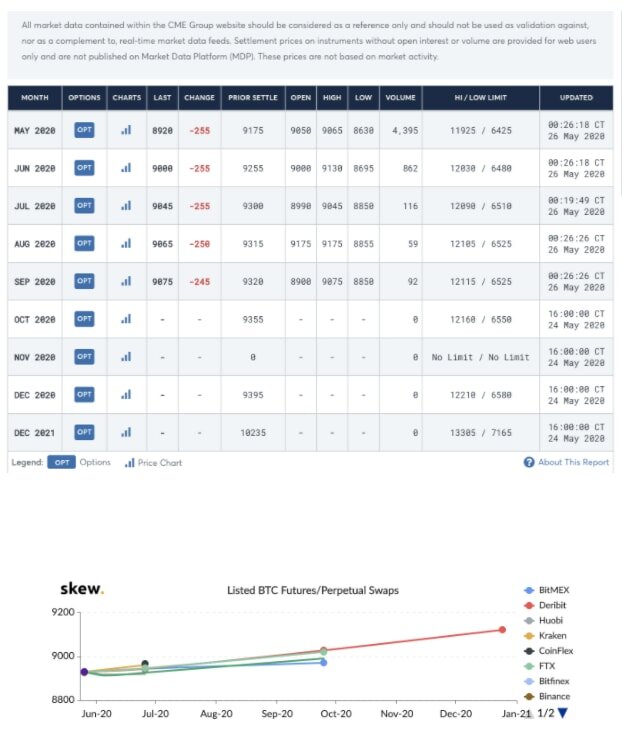

CME bitcoin options volume / OI

The CME launched bitcoin options at the start of 2020. Trading volumes swelled in May. OI increased from $35M on the day of halving to $174M (397% growth.) According to The Block, 3,059 bitcoin options contracts traded hands between May 12 and May 19. 81% of these contracts belonged to 5 block trades. Block trades are exclusively available to institutions, who meet AUM thresholds. ~50% of total bitcoins options OI is set to expire this weekend.

Steep Futures Contango Curve

According to Arthur Hayes, CEO at BitMEX, in his must-read “In the Beginning There Was House:”

Holding physical Bitcoin in size is risky and difficult. The amount of money spent by the top exchanges on security is non-trivial. Therefore if there is a fiat margined derivative that gives them the same exposure, they hold that instead. Any hedge fund’s prime broker will have an account at the CME. Voila, they can now gain long exposure to Bitcoin.

Let’s assume a fund uses zero leverage. The leverage is very low on the CME Bitcoin futures contract anyway. The cost of going long futures and rolling each month will be expressed in the futures term structure or curve. I use back minus front as the roll pricing convention. That means if the roll is positive the curve is in contango. As a result there is a cost to roll each month if you are a long holder and the curve is in contango. If the cost to roll each month is greater than the cost to properly secure a large amount of Bitcoin (assume large is >$100mm notional), then a fund would consider self or third-party custody. I posit that the difference in cost has to be extremely large before it makes sense to onboard the risk of custodying crypto to your fund operations. The thundering herd of wanna-be macro fund managers will be demonstratively evident if the CME curve blows out into a massive contango over the non-US platforms. The CME curve should trade richer than all other Bitcoin futures platforms. The reason is collateral.

The rise of institutional infrastructure for digital assets

According to The Block, ~115 firms are building out institutional infrastructure. To date, $2.1B in investments have been allocated to institution-serving firms, with $1.2B of that going toward companies focused solely on institutions.

What To Read

🌐 MACRO / WHY BITCOIN?

🌐 The state of Bitcoin network security: Karim Helmy and the Coin Metrics Team explain that post-halving, many formerly-offline S9s miners have been turned on, and are now responsible for ~32% of Bitcoin’s hashpower. The halving had the expected outcome of lowering the hashrate and increasing fees. A decrease in the difficulty adjustment should push the hashrate upward. While the halving made miners less profitable, the adjustment should improve margins.

🌐 Early mined bitcoin movement leads to BTC sell-off: 40 bitcoins mined in the first month of Bitcoin’s existence in 2009, were transferred after more than a decade of inactivity. Crypto Twitter debated whether the transaction came from a wallet belonging to Satoshi Nakamoto, the protocol’s creator. The “Patoshi pattern,” a specific pattern in the nonce (BitMEX primer), is believed to identify blocks likely mined by Satoshi. Nic Carter, Founder of Coin Metrics, explains that the 40 BTC were not mined under that Patoshi pattern.

🌐 Increased confidence BTC will emerge as a store of value: Avichal Garg, Managing Partner at Electric Capital, released an excerpt of his quarterly LP letter: “we are more optimistic than ever about the emergence of a new programmable money infrastructure, with a non-sovereign store of value as its first killer application. Governments’ unprecedented monetary and fiscal stimulus is hastening the emergence of a world where cryptocurrencies and crypto infrastructure will thrive.”

🌐 The big cycles over the last 500 years: In Chapter 3 of his series “The Changing World Order”, Ray Dalio, founder of Bridgewater Associates, reviews the rises and declines of the Dutch, British, and American empires and their reserve currencies and touches on the rise of the Chinese empire.

💰 FUNDING, M&A, EXITS

💰 Travala.com, an accommodation travel booking platform that prides itself on allowing users to pay with crypto, announced its merger with Binance’s TravelbyBit, a crypto-friendly flight booking portal, to create a blockchain-based booking agency. The companies will cross-market one another’s offerings. A full integration will create an online travel agency with over 2M hotels and 600 airlines. The companies currently offer multi-currency payment platforms, supporting payments in fiat and 25 cryptocurrencies. One step forward for the medium of exchange use case. Financial terms of the merger were not disclosed.

💰 Vo1t, an institutional-grade custodian, was acquired by Genesis Capital, a subsidiary of DCG. Genesis is gearing up to launch Genesis Prime, a prime brokerage focused on cryptoassets. Genesis will launch an integrated client interface, additional technology solutions, a derivatives trading desk, and add capital introduction capabilities for hedge funds, quant funds, asset managers, and family offices. Financial terms of the acquisition were not disclosed.

💰Fluidity, the developer of AirSwap, a P2P trading platform on Ethereum, and producer of several industry firsts in real-estate tokenization, tokenized securities trading, and systems to pledge real collateral to decentralized credit platforms, was acquired by ConsenSys. The team will continue to build AirSwap with the support of the BD, engineering, and marketing teams at ConsenSys. Fluidity tech will also be leveraged by ConsenSys Codefi to power commerce and decentralized finance. Financial terms of the acquisition were not disclosed.

💰Casa Inc., a provider of non-custodial Bitcoin storage and security, announced an investment from Mantis VC, a venture fund co-founded by The Chainsmokers focused on consumer and fintech companies. Mantis joins Casa’s industry-leading group of existing investors, including StillMark, Castle Island Ventures, Lerer Hippeau, and Precursor Ventures. Financial terms were not disclosed.

🔓 DEFI / CEFI / OPFI

🔓 UMA creates its first synthetic token: The UMA community approved smart contracts that create its first synthetic token to track ETHBTC built using UMA’s priceless infrastructure. UMA’s priceless token model minimizes the need for oracles, allowing for the synthetic ETHBTC token to track the relative value of ETH to BTC. The ETHBTC token is collateralized with DAI, and its value moves along with the ETHBTC index. The synthetic token can be traded on Uniswap v2. AlfaBlok released a primer on UMA economics, exploring how the protocol generates benefits to users, sponsors, and $UMA holders.

🔓 Uniswap v2 should grow liquidity and volumes: Uniswap, the largest decentralized exchange by trading volume accounting for ~30% of DEX volume, released V2 on the Ethereum mainnet. V2 increases profitability for liquidity providers, reduces slippage, and includes a number of tech improvements including ERC20/ERC20 swaps, enhanced price oracles, adjustable protocol fees, and flash swaps. Most notably, Uniswaps’ new protocol fee (currently set at 0%) provides a means for sustainable funding and suggests a decentralized governance process powered by a Compound-like governance token. Kyle Samani, GP of Multicoin Capital, has great tweetstorm on the upcoming evolution of liquidity in the DEX market: “the DEX space is going to look and feel a lot more like the CEX space (deposit, trade, withdraw), but it will retain DEX's native non-custodial and censorship resistance.”

🔓 2 steps forward, 1 step back on the promise of bringing Bitcoin to Ethereum: On May 15, the alpha version of tBTC, a trustless platform for making bitcoin-backed tBTC tokens, went live on the Ethereum mainnet. However, a few days later, the 10-day emergency pause of deposits allowed by the TBTCSystem contract was triggered, after an issue in the redemption flow of deposit contracts was identified that put signer bonds at risk in certain situations. Shortly after the pause, a BTC-for-TBTC exchange was initiated that resulted in the recovery of 99.83% of the supply to this address. The removal of any remaining unused ETH in the system is currently underway. The Thesis team released a post-mortem of the incident. Meanwhile, efforts to bring bitcoin to Ethereum have ramped up led by WBTC, an ERC-20 token created by placing deposits of bitcoin with crypto custodian BitGo. Following the approval of WBTC as collateral on MakerDAO in early May, WBTC's total value locked tripled and now sits at ~$35M (according to DefiPulse) as Maker offers the cheapest access to leverage for BTC holders. 68% of total WBTC supply is now locked in Maker.

💸 STOs / TOKENS / DAOs

💸 $4M in tokenized equity distributed to investors: TokenSoft, a security token issuance platform, used its own product to distribute $4M in tokenized equity to investors. Seed investors, which include Base10, e-ventures, Coinbase Ventures, and Avon Ventures, received a digital representation of their SAFE-governed investment developed using the ERC-1404 standard and use the Ethereum blockchain for compliance and accounting automation to ensure the agreement are enforced on the blockchain. Investors can access real-time ownership information, with the provenance of transactions recorded on Ethereum, have access to real-time USD dividend payments, by way of Signature Bank’s Signet, and the ability to trade shares on the secondary market.

💸 Crypto M&A, hostile takeovers, and exchange drama: The TRON-controlled Steem proof-of-stake blockchain hard forked to create New Steem. A Steem blog post announcing the hard work controversially indicated New Steem would “seize some user accounts that participated in criminal activities by actively contributing to the threat against the Steem blockchain and/or to the theft of STEEM holders’ assets.” New Steem is blacklisting 65 accounts which collectively hold 23.6M STEEM, currently worth ~$6.3M, effectively seizing the tokens of community members who opposed TRON’s acquisition of Steemit, including former Steem witnesses as well as others who created another, anti-Tron, fork of Steem called Hive. Binance CEO Changpeng Zhao (CZ) released a statement criticizing calls for class-actions lawsuits against exchanges that support New Steem. Ari Paul, Co-Founder of BlockTower Capital, has a great tweetstorm exploring important issues about large token holdings by centralized exchanges or custodians and future implications for voting in PoS networks.

💱 STABLECOINS & CBDCs

💱 Stablecoins market cap near all-time highs: According to TradeBlock, demand for stablecoins fueled a significant increase in new token issuance, driven by Tether (USDT). Since January, the total circulating supply of Tether has more than doubled from $4.1B to $8.7B. Total market cap across the leading stablecoins now stands at ~$10B. USDT maintains the majority of stablecoin market share followed by USDC and PAX. According to ETH Gas Station, exchange-to-exchange transfers of Tether are driving up Ethereum gas fees with users paying ~$1.6M in the past 30 days.

🍰 LAYER 1

🍰 Celo Mainnet launched: After raising $40M to fund its proof-of-stake blockchain platform, Celo’s cLabs announced the launch of Mainnet. Celo announced that transfers of Celo Gold (cGLD), an ERC-20 token, are enabled via on-chain governance, meaning exchanges are free to integrate with the platform.

🍰 Decentralizing layer 1 governance: Blockstack, a decentralized computing network and app ecosystem, launched The Stacks Foundation, a non-profit that will work to decentralize the protocol.

⚖️ LEGAL

⚖️ SIM Swapping attacks on the rise: BlockFi, a leading crypto lender, announced a data breach that revealed customer PII but did not comprise user funds. The breach was the result of a SIM-swapping attack on an employee's phone number. Anectodely, SIM swapping attacks have spiked in the last week as hackers are targeting customer data leaked in the BlockFi incident. Meanwhile, the New York Post has a great story on Ellis Pinsky, a teen at the heart of the Michael Terpin hack. Secure your accounts ASAP (MyCrypto guide here).

🎥 PODCAST & VIDEO OF THE WEEK

📅 Upcoming Events / Conferences

May 28: Chainalysis: Advanced Obfuscation Techniques (Virtual)

May 29: Chamber of Digital Commerce: Parallel Summit (Virtual)

June 1-3: The Mainnet by Messari (Virtual)

June 24-26: Remote Crypto Con (Virtual)

June 15-21: Korea Blockchain Week (Seoul)

July 6-7: M2 Asset Management (Oxford)

July 15-16: Asia Blockchain Summit (Taipei)

July 22-23: Mining Disrupt (Miami)

🎓Highlighted Industry Jobs (non-exhaustive list for NY)

If you would like to highlight jobs or internships in future editions, please email links here.

Open Roles in Engineering, Product, Sales & Marketing, Operations:

BlockWorks Group - Account Executive (new)

Streamr - Head of Developer Relations (new)

Staked - Sales Development Representative

3Box - Senior Software Engineer / Full Stack / Backend Engineer

Deloitte Catalyst - Ecosystem and Alliances Blockchain Go To Market Lead

Gemini - Technical Operations SRE Lead

Square CashApp - iOS Engineer - Banking, Cash App

BlockFi - Trading Developer / Product Manager

Transak - Full Stack Engineer

Grayscale - Director, Technical Product Management / Legal Associate

Bison Trails - Protocol Specialist / Various

Fabric Ventures - Web 3.0 talent form

Nothing written in RelayNode NYC is legal or investment advice and should not be taken as such. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.