RelayNode NYC #48 - April 13 - Global dollar shortage. Crypto's time to shine?

Welcome to RelayNode NYC Area edition! The NYC blockchain ecosystem is growing. Our goal is to harness its energy and innovation for the benefit of New Yorkers and provide a weekly curated list of interesting content, upcoming (virtual) events, and local jobs.

RelayNode Links: Sign up | Submit events

RelayNode NYC is curated by:

Founder @GogelX/Definancier, Advisor @Paperchain.io, fmr Associate @Techstars' Blockchain Accelerator, Co-president @Wharton FinTech, Corp Dev @LinkedIn @AIG

Market Stats (as of Sunday, April 12, 10 PM EST)

Risk assets rallied last week on the heels of “improving sentiment.”

Yet, over the last 3 weeks, ~17M people in the US are newly unemployed and the Fed added ~$2T to its balance sheet (9% of US GDP). The Fed’s balance sheet now sits at $6T. Are we entering a V / U-shaped recovery or is this a short-term bounce in a longer-term deleveraging?

Over the weekend, Bitcoin rapidly reversed after it broke the $7,200 support area. Major altcoins declined steadily.

1 Big Thing: The Global (Fiat) Dollar Shortage

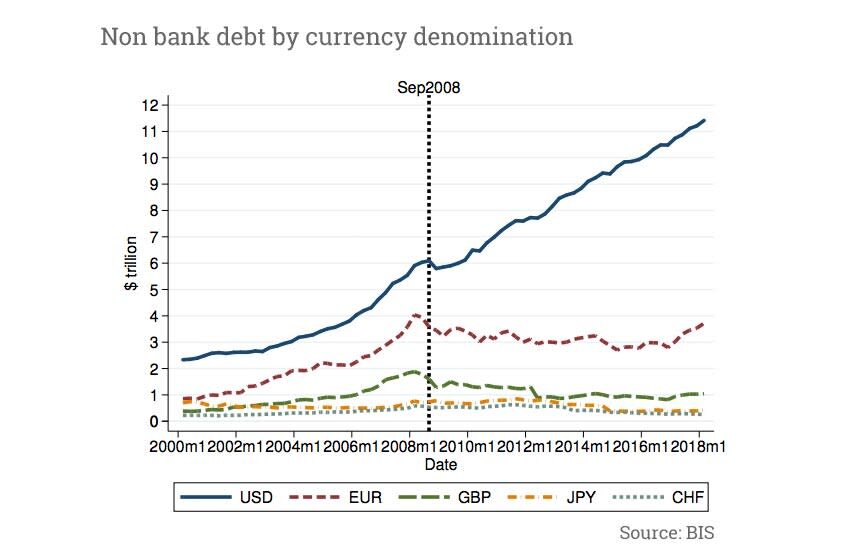

In the last decade, the USD’s dominance in international trade has rapidly increased.

However, with the recent collapse in international trade and commodity prices, dollars outside of the US are in short supply relative to the size of the dollar-denominated debts that those dollars need to service. COVID-19 has accelerated a global dollar shortage crisis with traders rushing into the USD in March. The increase in dollar funding costs was so high that it wiped out any yield international borrowers might have gained, forcing them to sell the US assets or fund their USD borrowings at a loss.

So what does the USD strength have to do with crypto? According to Max Bronstein and Avi Felman:

“Crypto dollars, namely stablecoins and synthetic dollars created through derivative contracts, are uniquely positioned to help service the world’s dollar demand and will likely see immense growth in market capitalization as the world looks for easier and more programmable ways of storing, transacting, and financing in dollars. For a technology lauded by enthusiasts as a way to escape the dollar, cryptocurrency might actually do more in the near term to strengthen the dollar rather than to weaken it.”

Go Deeper:

Max Bronstein / Avi Felman: Crypto Dollars and the Evolution of Eurodollar Banking

Zero Hedge: "Down The Rabbit Hole" - The Eurodollar Market Is The Matrix Behind It All

Mises Institute: Why the World Has a Dollar Shortage, Despite Massive Fed Action

What To Read

🌐 Macro / Why Bitcoin?

Arthur Hayes, CEO & Co-Founder of BitMEX, explains “everyone knows the shift is upon us, that is why central bankers and politicians will throw all of their tools at this problem. And I will reiterate, that is inflationary because more fiat money will chase a flat to the declining supply of real goods and labor. There are only two things to own during the transition to whatever the new system is, and that is gold and bitcoin.”

Jesse Walden, an investor at a16z crypto, argues that “by making economic collaboration with users a primary feature of the product experience, founders may be able to unlock networks that are bigger, more competitive, and more defensible, while simultaneously enabling more innovation — all thanks to crypto’s open-source foundation.”

📈Crypto Trading

2 halvings, 1 more to go: Bitcoin Cash (BCH), which forked off of Bitcoin in 2017, successfully underwent its first block reward halving. At block height 630,000, the halving was triggered and block rewards declined from 12.5 BCH to 6.25 BCH per block. Bitcoin SV (BSV), which forked off of Bitcoin Cash, also successfully underwent its first block reward halving with rewards declining from 12.5 BSV to 6.25 BSV per block. The halvings’ immediate effects were a drop in revenue for miners competing for block rewards resulting in a reduced hash rate as miners migrated to more profitable chains. With both the BCH and BSV halvings completed, attention now turns to Bitcoin’s halving set to take place mid-May.

💰 Funding, M&A, & Exits

Sila, a banking and payments API platform to easily launch programmable USD stablecoins, raised a $7.7M Seed round led by Madrona Venture Group and Oregon Venture Fund. Funds will be used to accelerate growth and introduce new product features.

BlockFi, the crypto lending startup, announced that it has brought on Three Arrows Capital, the Singapore-based hedge fund, as a strategic investor. The fund has been an institutional client of BlockFi. BlockFi plans to open an office in Singapore to expand into Asian markets. BlockFi raised $30M in a Series B in February only a few months after their $18M Series A.

LGO, the institutional bitcoin exchange, sold equity and a token stake to B2C2, the crypto market maker. Previously, LGO raised 3,600 bitcoin (~ $32.5M) via an ICO in February 2018. Financial terms were not disclosed.

Cadence, the securitization platform with $125M+ in deal volume operating on top of Ethereum, raised a $4M Seed round led by Revel VC, with Revel’s Thomas Falk, Navtej S. Nandra, former President of E*Trade, and portfolio manager Oliver Wriedt joining the company’s board.

Galileo, a payment software company offering APIs to connect banks to credit card processors, was acquired by SoFi (which allows for crypto trading via SoFi Invest) for $1.2B, in a deal comprised of $75M in cash, $250M in seller financing debt and $875M in SoFi company stock. The cash-and-stock deal will help the companies launch new products, expand internationally and capitalize on consumers’ shift to digital finance.

According to PwC, fundraising in the crypto space has shifted from the US to Asia, Europe, and Africa. Further, both the number and value of crypto-related fundraisings and M&A declined last year. M&A value dropped 76% from $1.9B in 2018 to $451M in 2019, while the amount of funds raised sank 40% to $2.24B.

🔓 DeFi / OpFi

DeFi Alliance: Several of Chicago's leading trading firms — Volt Capital, Jump Capital, CMT Trading, DRW Trading, TD Ameritrade, and Cumberland —joined forces to launch the Chicago DeFi Alliance (CDA) to support startups in crypto finance at all stages with access to market makers, liquidity, product feedback, professionalized traders and talent.

DeFi Transparency: ConsenSys launched CodeFi Inspect, an open-source registry dedicated to protocol transparency in DeFi, tracking all public audits, admin key details, oracle dependency and on-chain activity.

DeFi Growth: DappReview released its 2020 Q1 Dapp Market Report, highlighting total transaction volume of $7.9B across 13 blockchains, increasing 82.2% compared to 2019 Q1. Ethereum, TRON, and EOS, contributed 99.1% of the total volume. Ethereum-based DeFi projects are the main volume growth driver, increasing 778% compared to 2019 Q1.

Alethio released its 2020 Q1 DeFi report, highlighting DeFi user behavior, the COVID-19 and Black Thursday market events, the February bZx incidents, an DeFi outlook for the rest of 2020, and the performance of specific high-profile DeFi protocols, including Uniswap and MakerDAO.

💸 STOs / Stablecoins / Tokens / DAOs

Trusted, decentralized venue for exchanging data: Joel Monegro, Partner at Placeholder VC, details his investment thesis on Erasure, a protocol for exchanging valuable information on the internet, using encryption, smart contracts, and staking with the Numeraire token (NMR).

Tezos gets a link to Bitcoin liquidity: The Bitcoin Association Switzerland announced the launch of tzBTC, a token on the Tezos blockchain that is backed 1:1 by Bitcoin. The news comes on the heels of the tBTC bridge between Ethereum and Bitcoin announcement.

Overstock Digital Dividend: On May 19, Overstock will distribute its security token shareholder dividend after receiving eligibility this week from the DTC. This eligibility allows for depository and book-entry services at DTC.

The rise of CBDCs: The BIS issued a report arguing in favor of Central Bank Digital Currencies. The report notes a significant negative change in consumer attitudes regarding the use of cash in response to the WHO’s warning regarding the spread of COVID-19 via banknotes.

🌉 Infrastructure

Fidelity Digital Asset announced it is signing on as a member of ErisX’s clearinghouse, taking advantage of its central limit order book to provide better liquidity for buy / sell orders. Fidelity Digital AssetsSM can access the ErisX spot market, increasing the breadth of accessible liquidity available to customers.

🎧 Podcast / Video of the Week

Upcoming Virtual Events / Conferences

Virtual

April 13: CryptoMondays Fireside Chat w/ DeFi Dad, Senior ConsenSys Exec & Ethereal Summit Co-Lead (Virtual)

May 1-2: DeFi Discussions Conf (Virtual)

May 7-8: Ethereal Virtual Summit 2020 (Virtual)

May 11-13: Consensus 2020 (Virtual)

June 1-3: The Mainnet by Messari (Virtual)

June 24-26: Remote Crypto Con (Virtual)

Conferences (Status TBU)

May 12: The Block Summit (New York) (Status TBU)

July 6-7 - M2 Asset Management (Oxford) (Status TBU)

July 15-16 - Asia Blockchain Summit (Taipei)

July 22-23 - Mining Disrupt (Miami)

Sep 28-30 - Hong Kong Blockchain Week 2020

October 7-8 - Token2049 (Hong Kong)

November 2-8: Korea Blockchain Week (Seoul)

Q3 (tbd) - Bitcoin2020 (San Francisco)

🎓Highlighted Industry Jobs (non-exhaustive list for NY)

If you would like to highlight jobs or internships in future editions, please email links here.

Bakkt - Various Engineering (new)

Elementus - Developer

Axoni - Director, Enterprise Solutions

LedgerX - VP of Finance

Gemini - Various

Chainlink - Developer Evangelist

Paxos - Various

Ripple - Various

ConsenSys - Various

Pantera Portfolio Co - Various

Chainalysis - Various

Messari - Various

ConsenSys Labs - Various

R3 - Various

Coin Metrics - Data Scientist

UMA - Various

Bison Trails - Various

BlockFi - Institutional S&T Associate

Republic - Biz Ops Associate Tokenization

According to LinkedIn, “blockchain” tops the list of most in-demand hard skills for 2020

Check out Cryptocurrency Jobs’ state of the hiring market report

Nothing written in RelayNode NYC is legal or investment advice and should not be taken as such. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.