RelayNode NYC #46 - March 30 - It's the Remix to Inflation, Hot & Fresh Out the Kitchen

Welcome to RelayNode NYC Area edition! The NYC blockchain ecosystem is growing. Our goal is to harness its energy and innovation for the benefit of New Yorkers and provide a weekly curated list of interesting content, upcoming (virtual) events, and local jobs.

RelayNode Links: Sign up | Submit events

RelayNode NYC is curated by:

Founder @GogelX/Definancier, Advisor @Paperchain.io, fmr Associate @Techstars' Blockchain Accelerator, Co-president @Wharton FinTech, Corp Dev @LinkedIn @AIG

Market Stats (as of Sunday, March 29, 9:30PM EST)

The equities markets stabilized last week following the Fed’s announcement of new measures to support the economy. Most notably, the Fed is increasing the size of its balance sheet and conducting asset purchases of Treasuries and MBSs on an open-ended basis. Further, the Fed announced the establishment of 3 new lending facilities to support corporations, small businesses, and consumers, and the expansion of 2 of its already existing money market mutual fund and commercial paper facilities. The goal: normalize funding markets, increase inflation expectations, decrease nominal/real interest rates, and reduce credit spreads.

1 Big Thing: 2 Trillion Dollars Stimulus

COVID-19 ended the longest economic expansion and pushed the global economy into a recession. A return to “normalcy” will depend on the trajectory of infection rates, and the duration/depth of the recession in response to policy measures.

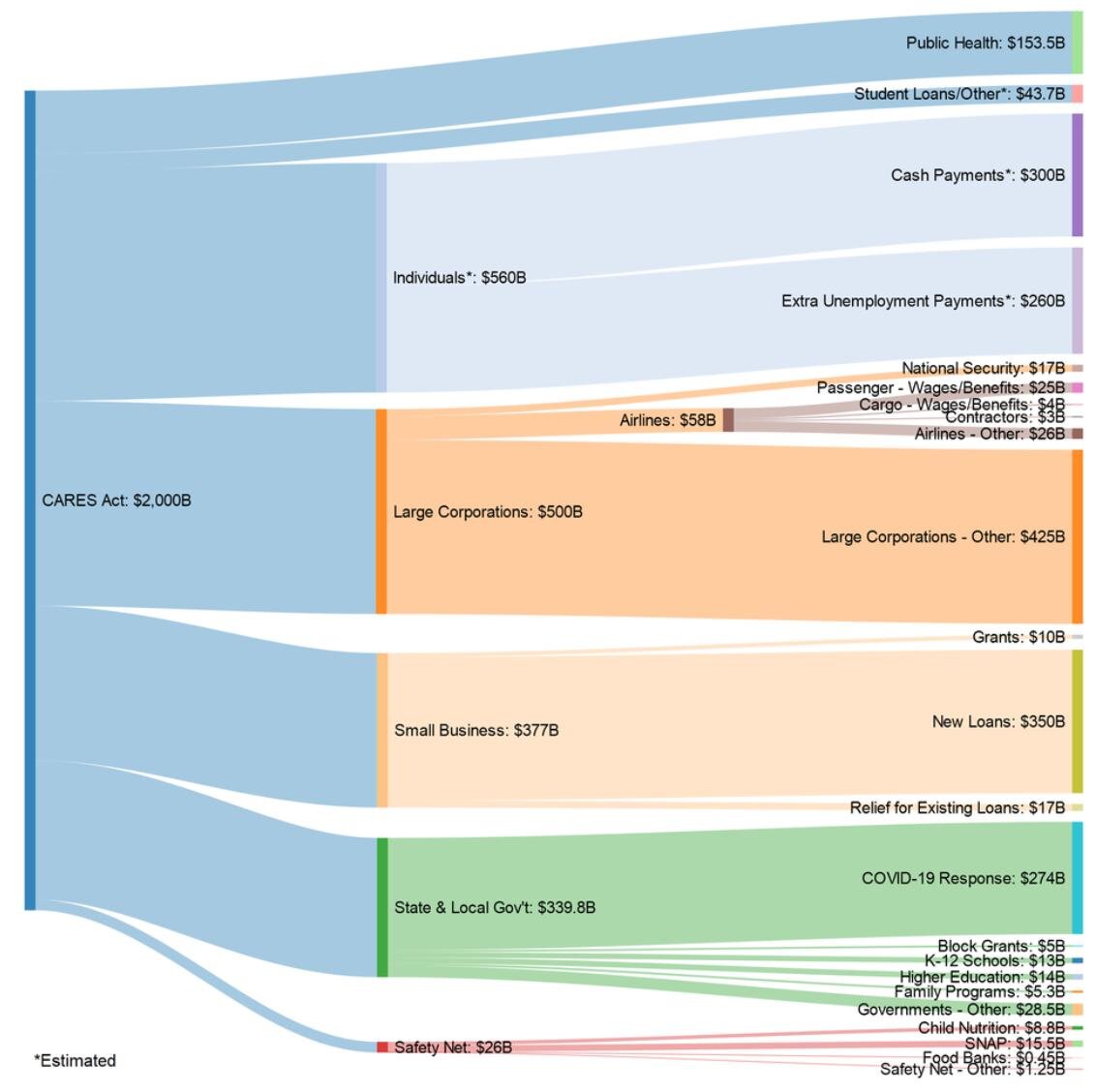

On Friday, Congress approved a historic $2T stimulus package. Here is a high-level chart of the distribution of funds (or check out the 880-pages document):

Central banks are once again directly funding government deficits through programs providing helicopter money for individuals and bailouts for companies. High unemployment (a record 3.3M Americans filed for unemployment on Thursday) is already here and inflation (will this be controlled?) is likely incoming. In an environment of increasing deficits, growing unemployment, devalued fiat currencies, increasing interest rate yields driven by inflation, and a continued decline in equities, will it be BTC’s time to shine? Or will USD-backed stablecoins take the spotlight?

What To Read

🌐 Macro / Why Bitcoin?

CZ, CEO and Co-Founder of Binance, published thoughts on whether Bitcoin is a safe heaven. Unsurprisingly, he states “long Bitcoin, short the bankers.”

Ray Dalio, Co-CIO & Co-Chairman of Bridgewater, published a new weekly newsletter called “The Changing World Order.” He turns to history to make sense of a changing world order fueled by the confluence of high levels of indebtedness coupled with low to negative interest rates as well as yawning wealth gaps and China’s rise.

Tony Sheng & Ben Sparango from Multicoin Capital explore the concept of trust and show how trust isn’t binary, but rather multi-dimensional. They break trust down into 5 properties: custody, immutability, verifiable security, legal and regulatory protections, and insurance. Using these properties, they develop a “trust score” for Bakkt, Coinbase, Tether, Compound, Maker, and Uniswap and show where they fall across those spectrums.

📈Crypto Spot & Derivatives Trading

Following the recent crypto market crash, Antoine Le Calvez and the Coin Metrics Team explore BitMEX’s role in the liquidation spiral. Good to read after BitMEX’s recent report explaining how liquidations and its insurance fund work.

Bitcoin’s mining difficulty declined by 16% on March 26, the second-largest decline in the network's history. The drop signals some miners have capitulated, as a decline in BTC’s price has made mining less profitable.

💰 Funding, M&A, & Exits

Coin Metrics, a blockchain data and analytics firm, raised a $6M Series A led by Highland Capital Partners with participation from Coinbase, Fidelity, Castle Island Ventures, Digital Currency Group, Dragonfly Capital, among others. Funds will be used to grow the team and expand its product offering.

Balancer Labs, a DeFi startup building a flexible and trustless platform for programmable liquidity on Ethereum, raised a $3M Seed from Accomplice, Placeholder, CoinFund, and Inflection.

Voice, the social media app launched by Block.one and built on a special-purpose blockchain based on the EOSIO protocol, received $150M from its parent company to kickstart operations.

CoinDCX, an Indian cryptocurrency exchange, raised a $3M Series A, led by BitMEX operator HDR Group, Polychain Capital and Bain Capital Ventures. CoinDCX plans to expand its products and services and hire more staff. The funding comes on the heels of the Supreme Court’s decision to reverse the RBI’s banking ban. CoinDCX claims to have achieved 10x growth in the first week since the ban reversal.

Solana, the smart contract platform, successfully completed a token sale for 8M SOL tokens (1.6% of the genesis block distribution) raising ~$1.8M from non-US buyers. Solana has raised $26M to date, with the latest round giving Solana a fully diluted valuation of $110M.

Neji, a startup building distributed ledger technology and networking technologies for businesses, was acquired by Brex to redouble its security, privacy and risk posture as Brex advances its product development roadmap. Financial terms were not disclosed.

🔓 DeFi / OpFi

UMA, the financial contracts platform on Ethereum, launched a new DeFi contract design for priceless, multi-sponsor, synthetic ERC-20 tokens that can track anything with a reference index. “Priceless” contracts are designed with mechanisms to incentivize counterparties to properly collateralize their positions without requiring any on-chain price feed.

Uniswap, a decentralized exchange, released details of its anticipated V2 launch. It is currently scheduled to launch in Q2 and it is available on Ropsten, Rinkeby, Kovan, and Görli testnets. New features include ERC20/ERC20 trading pairs, on-chain price oracles, sustainability fees, and flash swaps.

The Maker Foundation announced the successful transfer of MKR token control to the Maker governance community The MKR token contract is now 100% in control of MKR holders. This transfer comes on the heels of an MKR debt auction that not only serves to recapitalize the Maker system after market activity resulted in the accumulation of protocol debt.

💸 STOs / Stablecoins / Tokens / DAOs

HSBC placed $10B in paper-based private placement records on R3's Corda blockchain, with plans to "tokenize the private placements after it digitizes them.

Proposed House stimulus legislation included a recommendation to create a digital dollar. Under draft bills, dubbed the “Take Responsibility for Workers and Families Act” and the “Financial Protections and Assistance for America’s Consumers, States, Businesses, and Vulnerable Populations Act,” the Fed could use a “digital dollar” and digital wallets to send payments to “qualified individuals”.

🌉 Infrastructure

Binance announced the Binance Card, stating that "the Binance Card is issued by Visa and accepted by more than 46M merchants in 200 regions and territories, which makes shopping with crypto easier than ever before."

🍰🍰 Layer 2

Fast private payments are coming to Ethereum. Aztec announced its ZK² Rollup program, bringing cryptographic scaling to the Aztec network.

⚖️Legal

According to a recent examination report by the International Organization of Securities Commissions (IOSCO), global stablecoin initiatives might be subject to securities laws, with jurisdiction and regulation ultimately depending on project specifics.

Judge Castel of the United States District Court for the Southern District of New York sided with the SEC in its case against Telegram and issued a preliminary injunction against the distribution of GRAM token, finding that the distribution would violate U.S. securities laws. The court explained that the SEC had shown a substantial likelihood of success by providing that the contracts and ICO were part of a larger plan to sell GRAM to a secondary market. Telegram has appealed the decision to the US Court of Appeals Second Circuit.

🎧 Podcast of the Week

Upcoming Virtual Events / Conferences

Virtual

March 30: CryptoMondays: Fireside Chat With Shawn Cheng, Partner w/ ConsenSys (Virtual)

April 4-6: ZKProof workshop (Virtual)

May 1-2: DeFi Discussions Conf (Virtual)

May 7-8: Ethereal Virtual Summit 2020 (Virtual)

May 11-13: Consensus 2020 (Virtual)

June 8-10: The Mainnet by Messari (Virtual)

June 24-26: Remote Crypto Con (Virtual)

Conferences (Status TBU)

April 4-5 - Deconomy (Korea)

May 9-10: Magical Crypto Conference (New York City)

May 12: The Block Summit (New York)

June 15-21: Korea Blockchain Week (Seoul)

July 6-7 - M2 Asset Management (Oxford)

July 15-16 - Asia Blockchain Summit (Taipei)

July 22-23 - Mining Disrupt (Miami)

Sep 28-30 - Hong Kong Blockchain Week 2020

October 7-8 - Token2049 (Hong Kong)

Q3 (tbd) - Bitcoin2020 (San Francisco)

🎓Highlighted Industry Jobs (non-exhaustive list for NY)

If you would like to highlight jobs or internships in future editions, please email links here.

Elementus - Developer (new)

Kraken - Sales & Business Development Director (Indices) (new)

Elliptic - Sales Executive

Axoni - Director, Enterprise Solutions

MakerDAO - Cross-Functional Project Lead

LedgerX - VP of Finance

Gemini - Various

Chainlink - Developer Evangelist

Paxos - Various

Ripple - Various

ConsenSys - Various

Pantera Portfolio Co - Various

Chainalysis - Various

Messari - Various

ConsenSys Labs - Various

R3 - Various

Coin Metrics - Data Scientist

Grayscale - Director of Research

UMA - Various

Bison Trails - Various

BlockFi - Institutional S&T Associate

Republic - Biz Ops Associate Tokenization

According to LinkedIn, “blockchain” tops the list of most in-demand hard skills for 2020

Check out Cryptocurrency Jobs’ state of the hiring market report

Nothing written in RelayNode NYC is legal or investment advice and should not be taken as such. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.