Down the digital asset vortex: a macro review of the state of cryptoassets & blockchain

Originally posted on medium.com.

This is a good faith attempt to democratize access to knowledge and summarize much of my findings after spending 2+ years researching and meeting dozens of teams and investors at the edge of this fast-moving emerging industry.

I recently graduated from the full-time Wharton MBA program and spent the last 6 weeks documenting all my learnings as I reflect on my journey down the digital asset => crypto => blockchain vortex. I spend a lot of time thinking about the way the crypto industry works, what the future holds, and where we will end up in the next 10 years, because the technology both fascinates and disturbs me at the same time. I am a long-term HODLer (i.e., “Hold On For Dear Life”, long-term focused investor).

The following is a living document that summarizes my macro understanding and evolving thesis around cryptoassets and blockchain using visualizations, data, and strategic analysis intended as a research tool for entrepreneurs and investors alike. While comprehensive in scope (87 slides!!!), I understand that it does not cover everything and certain information may be incomplete, outdated, or oversights. I attempt to take on an objective view and vet information which is publicly-available, complex, technical, and decentralized. I provide information on my background below to help you understand the global set of experiences that have shaped my own biases.

This document is intended for informational purposes only. The views expressed in this document are not, and should not be construed as, investment advice or recommendations. Readers of this document should do their own due diligence, taking into account their specific financial circumstances, investment objectives and risk tolerance (which are not considered in this document) before investing. This document is not an offer, nor the solicitation of an offer, to buy or sell any of the assets mentioned herein.

The intersection of technology & finance has become my passion and an intellectual obsession — I hope it shows. Thank you to Michael Gogel, my family, friends, network, and the open-source community for supporting me along the entrepreneurial journey. Thank you for reading!

About Author

Hi, I’m David.

As background, I am French / American, born and raised in Paris France, graduated from the Huntsman Program at the University of Pennsylvania (Wharton / UPenn) undergrad in 2012 with a major in Finance / minor in Chinese. I worked for 4 years in corporate development @AIG in New York, Tokyo, and Hong Kong before pursuing my MBA back at Wharton in 2016, where I focused on entrepreneurship.

I first got into crypto in early 2016 after meeting the co-founder of BitMEX - Bitcoin Mercantile Exchange. After a short stint at an insurtech incubator in Singapore, I applied to business school with the goal of starting a fintech company. I became Co-President of Wharton FinTech, recorded several podcast interviews with startup founders and industry thought leaders, was involved with blockchain programming and the initial planning for the Penn Blockchain Club, and helped build out the fintech ecosystem on campus.

I spent last summer working in corporate development @LinkedIn in San Francisco and the fall studying at Wharton’s SF campus where I immersed myself in Silicon Valley and the crypto community. I spent my last few months of school working on various projects including doing due diligence on initial coin offerings, developing a quant trading algorithm with a classmate, and exploring the launch of a tokenized crypto VC/hedge fund. I am currently participating in ConsenSys online Summer Development Course and working towards my next play in the crypto economy. Please reach out!

ARE YOU READY TO GO DOWN THE DIGITAL ASSET VORTEX??

Full deck download here.

Last updated June 30, 2018

Document Outline:

Overview

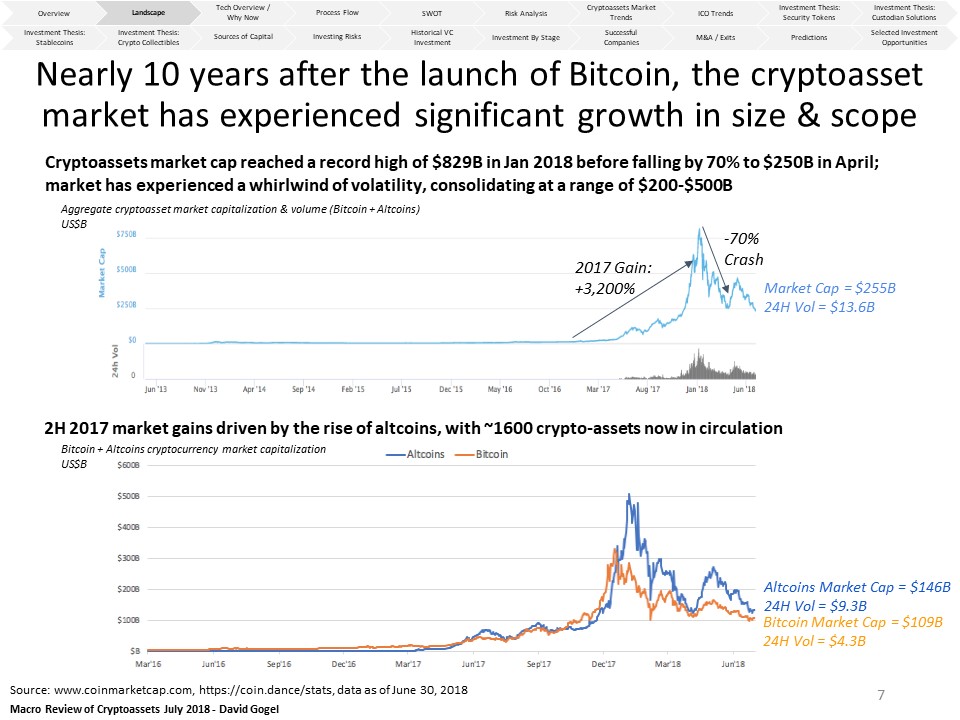

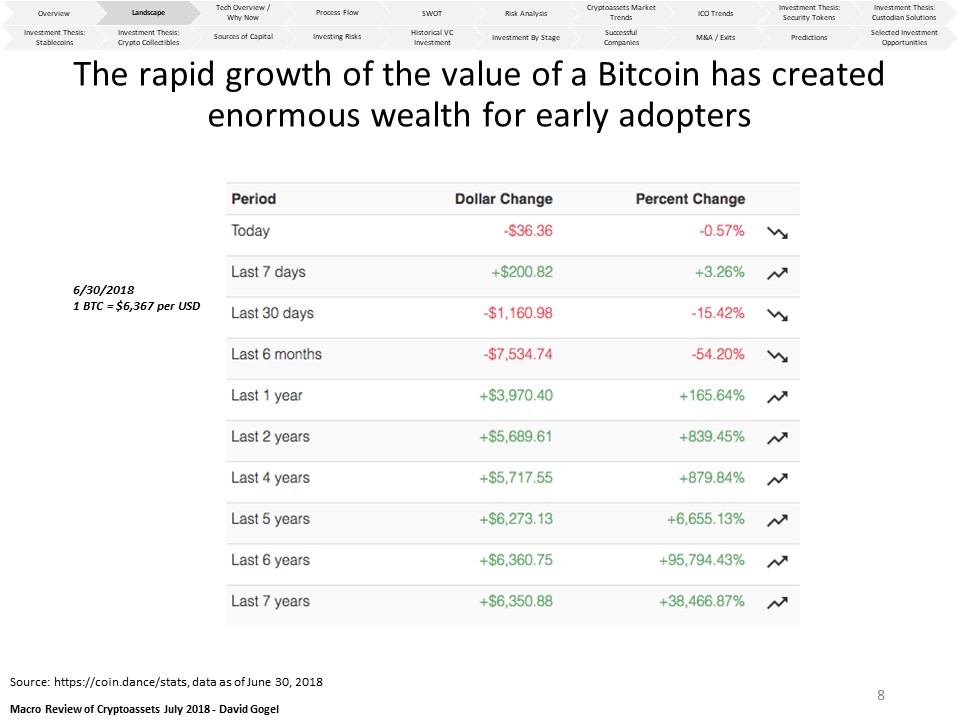

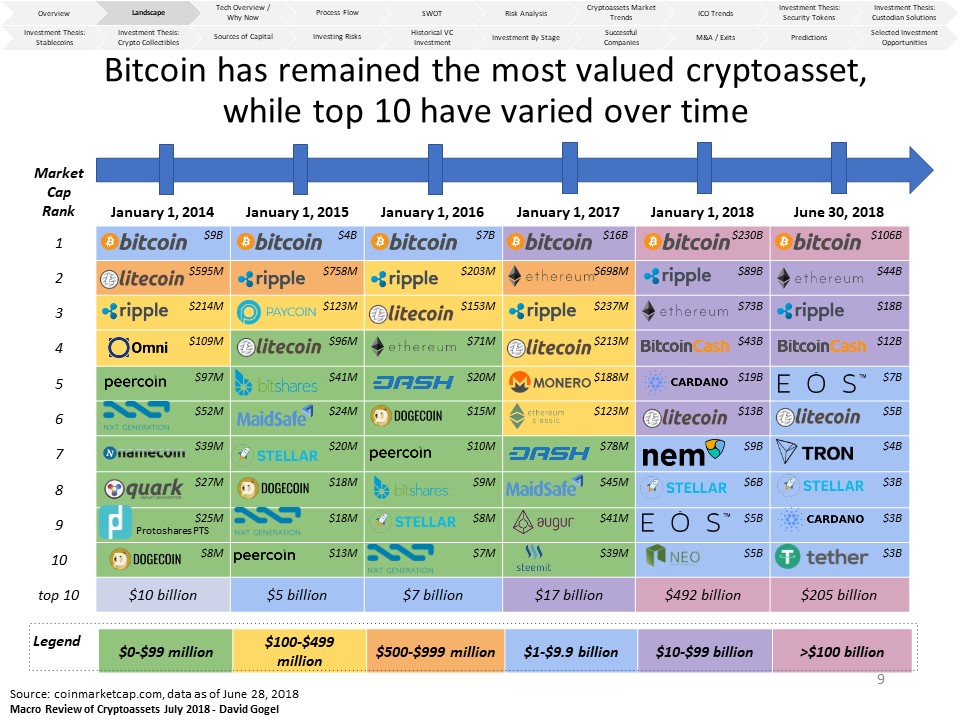

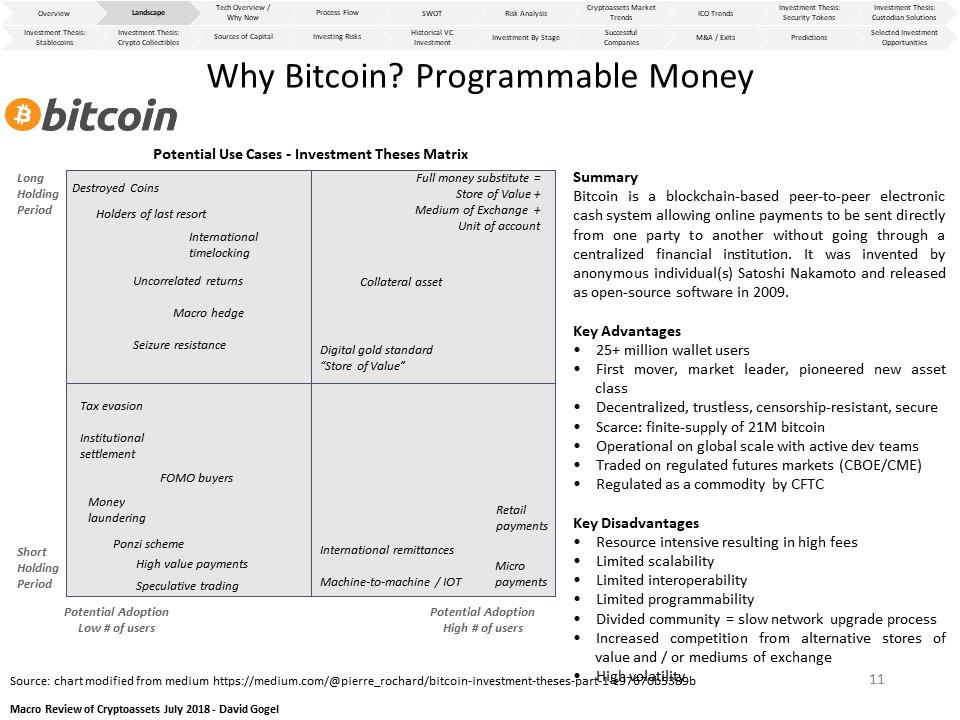

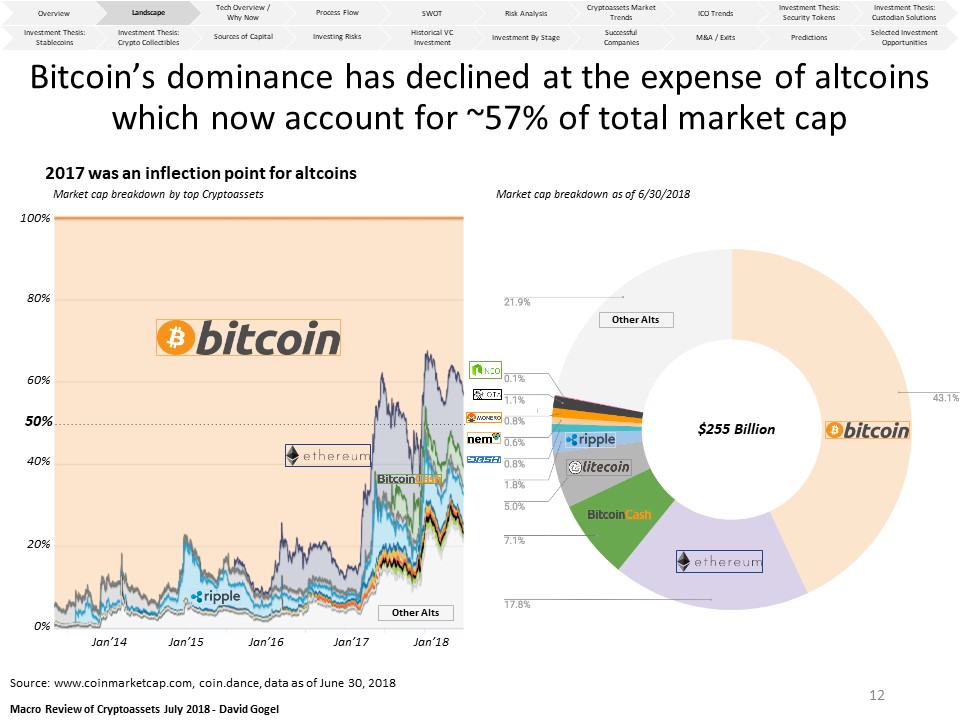

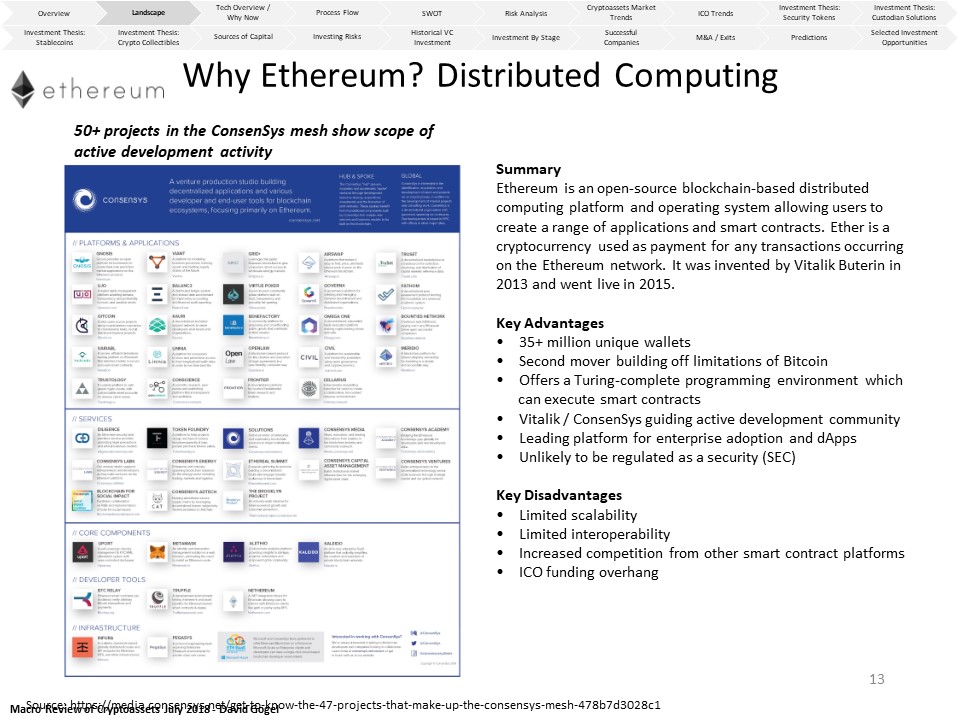

Landscape

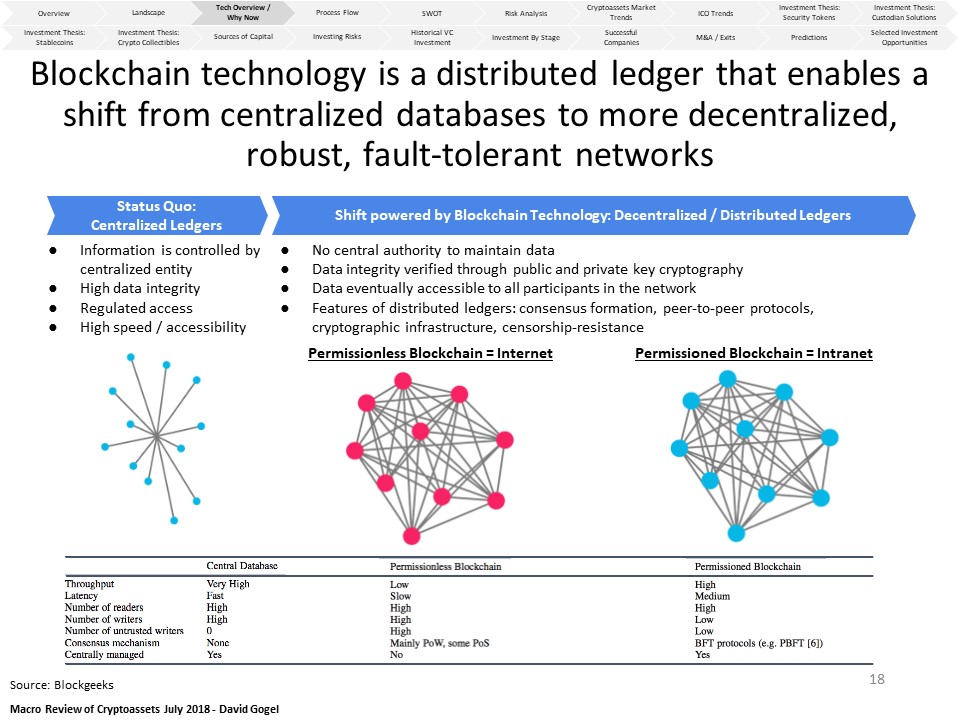

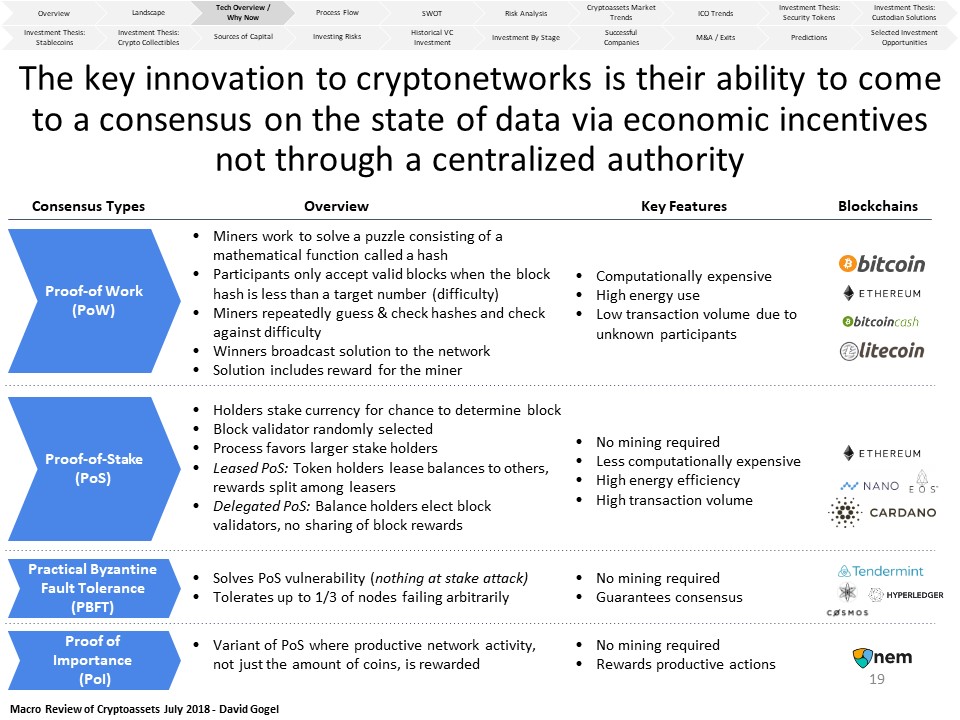

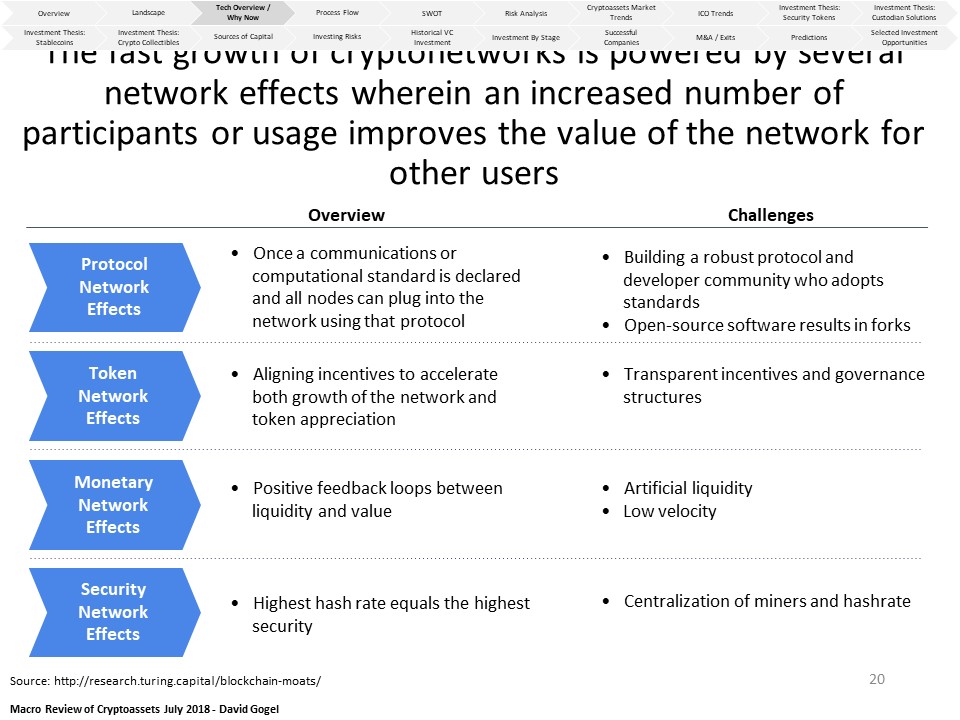

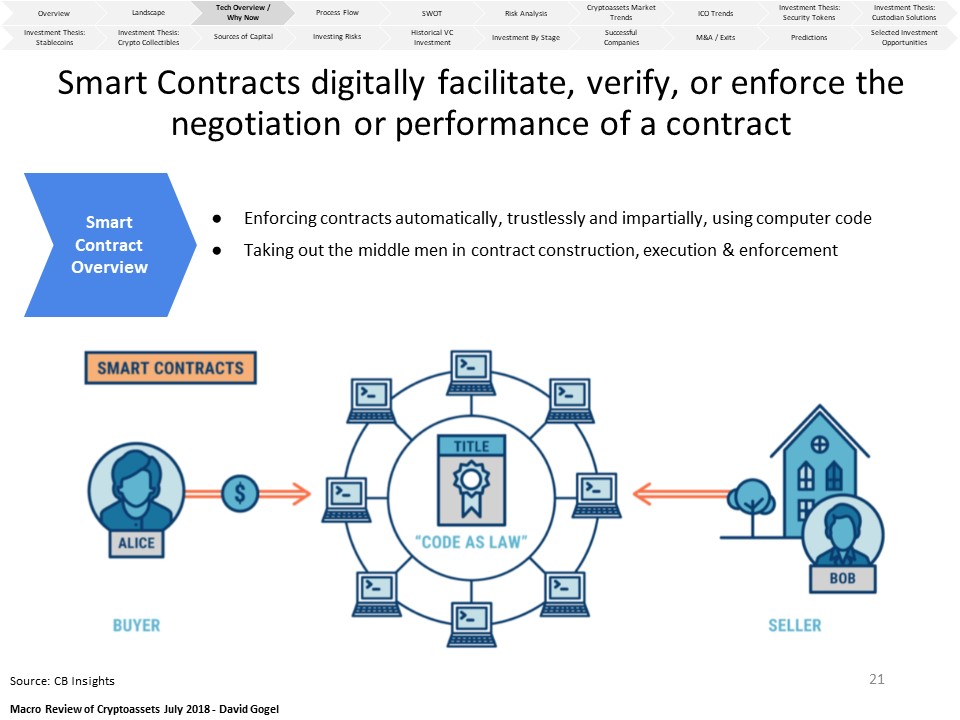

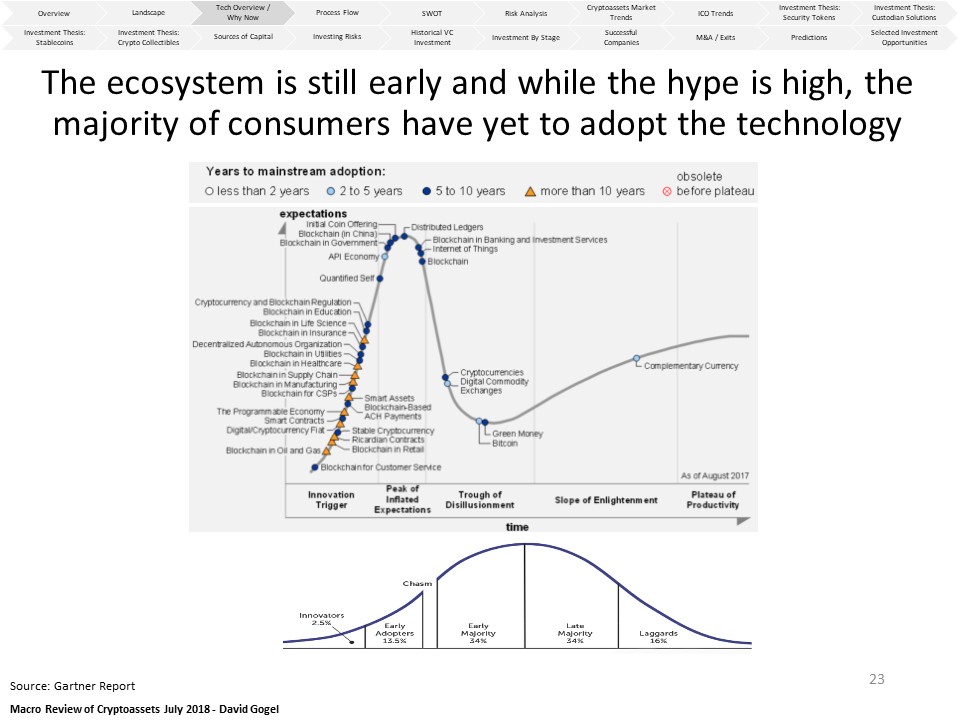

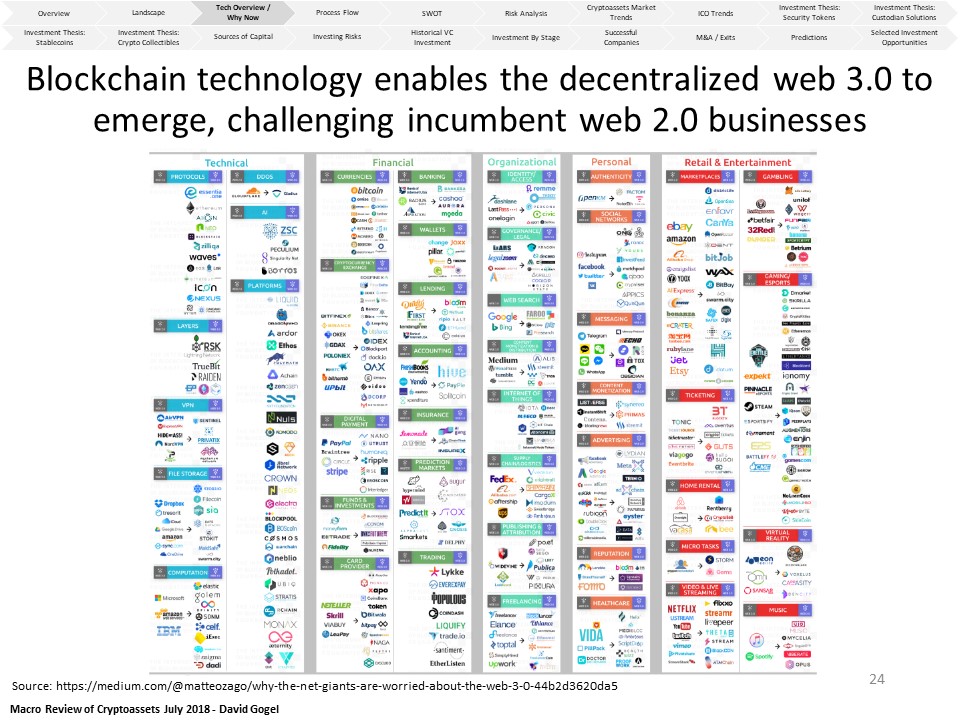

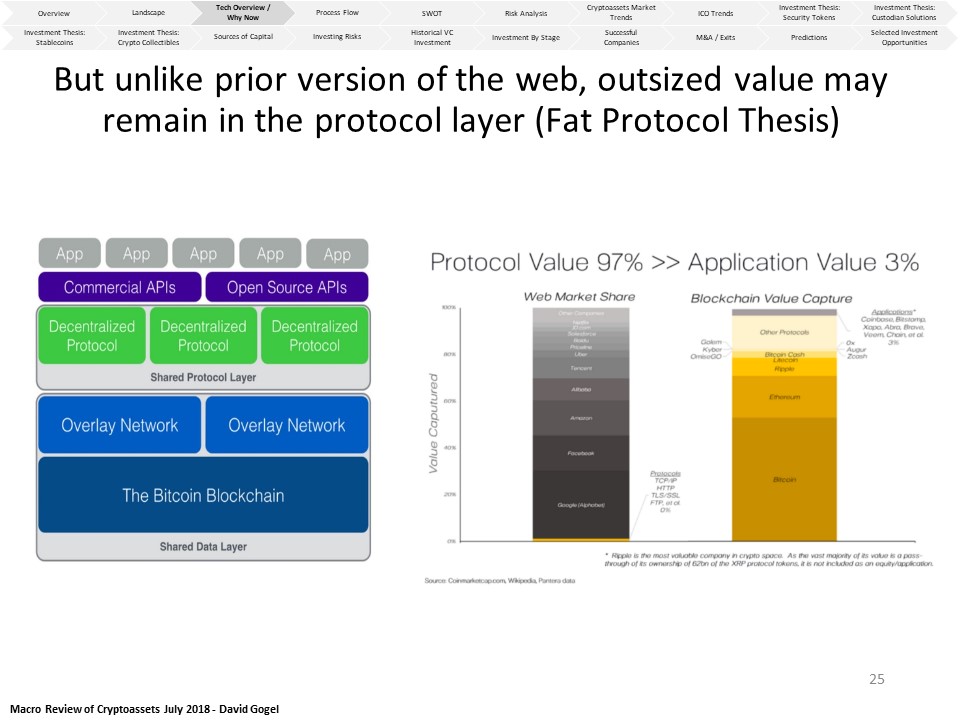

Summary of Tech / Why now

Process Flow

SWOT

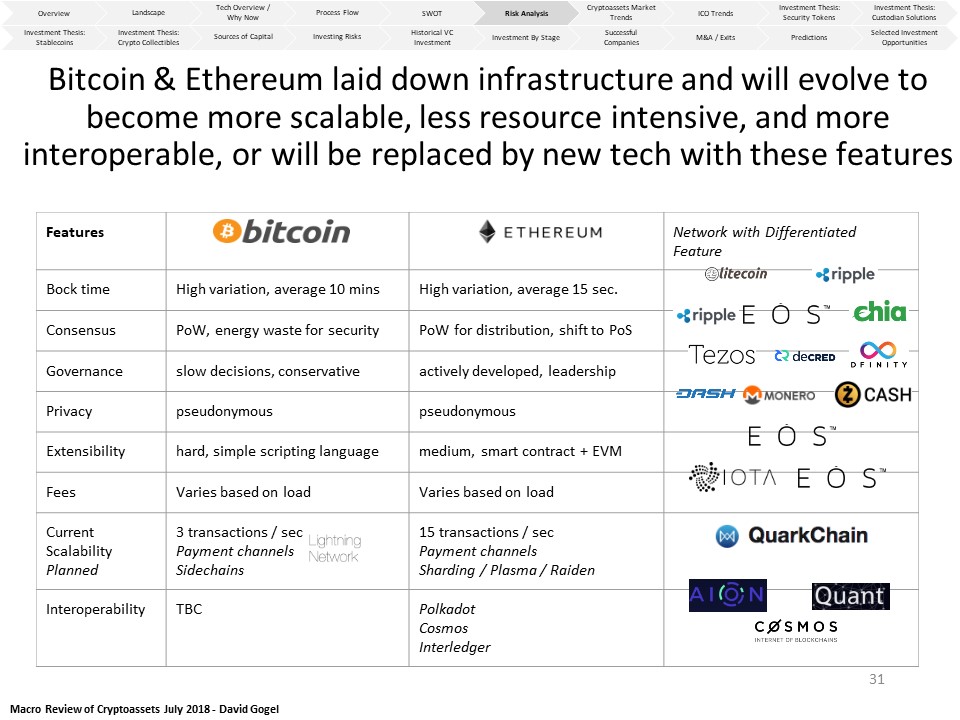

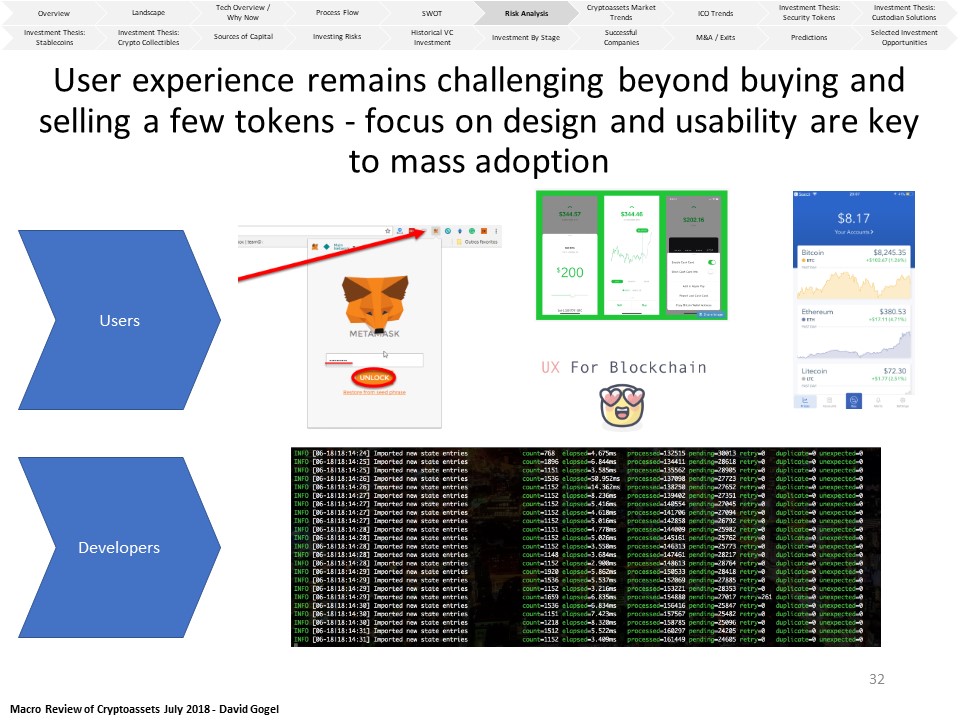

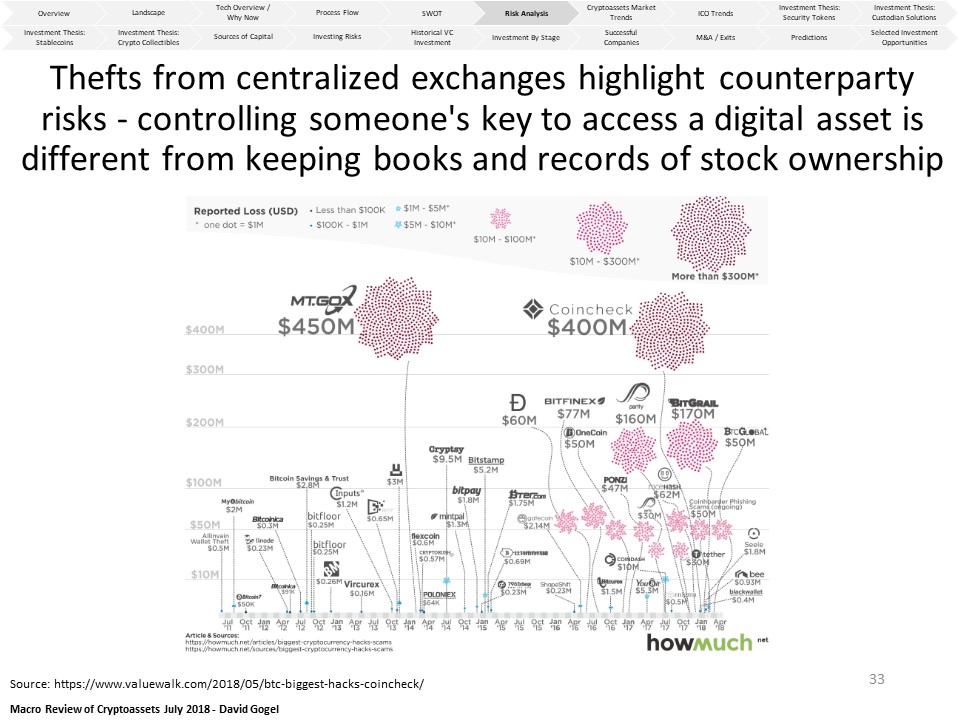

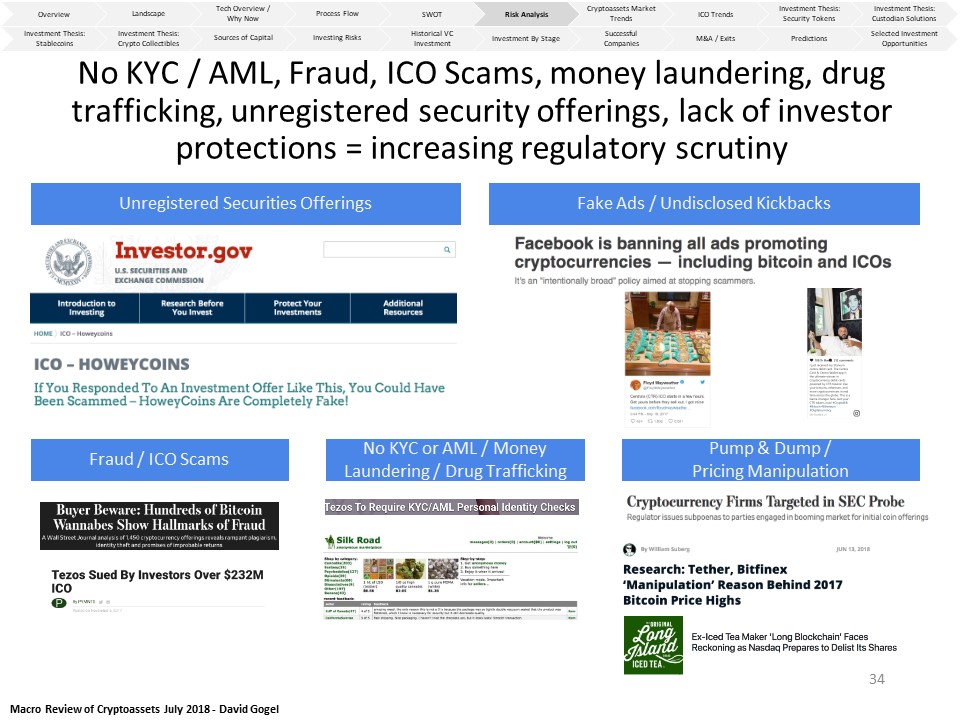

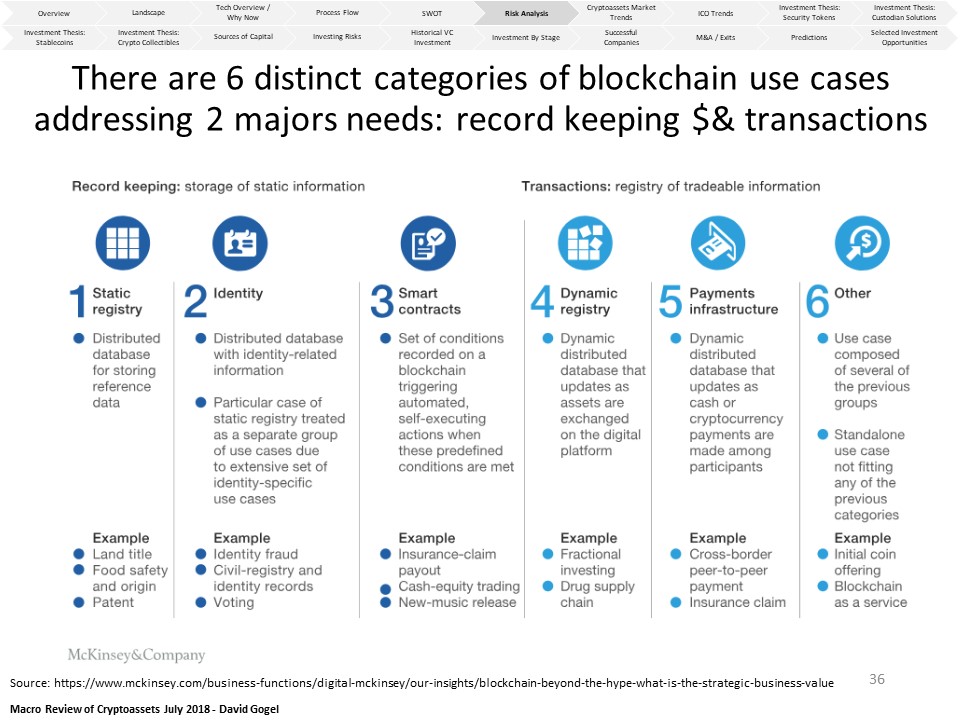

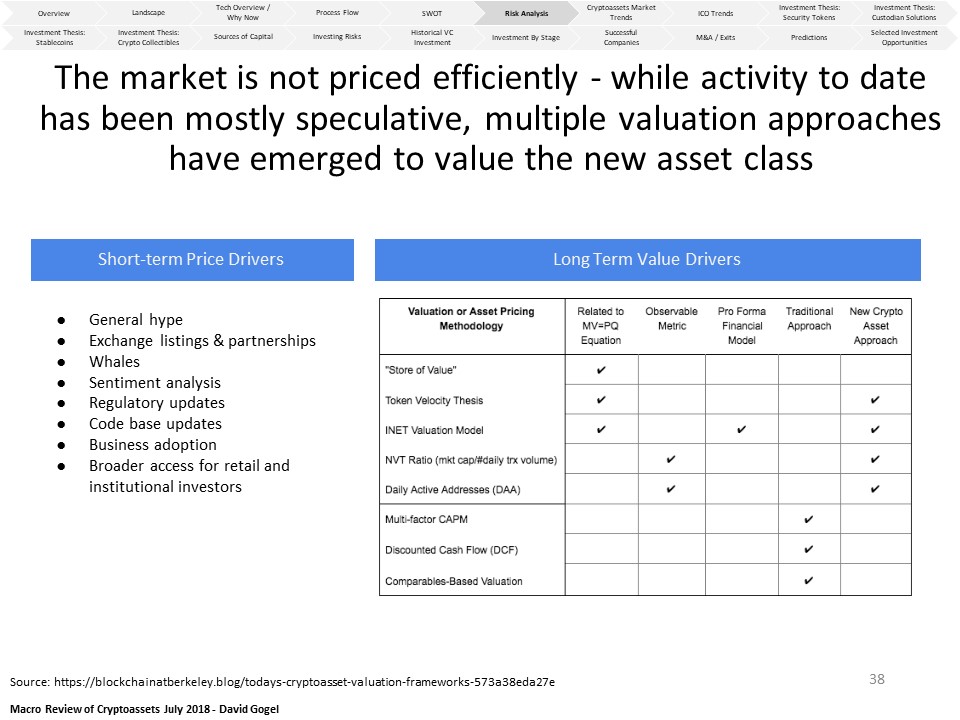

Risk Analysis

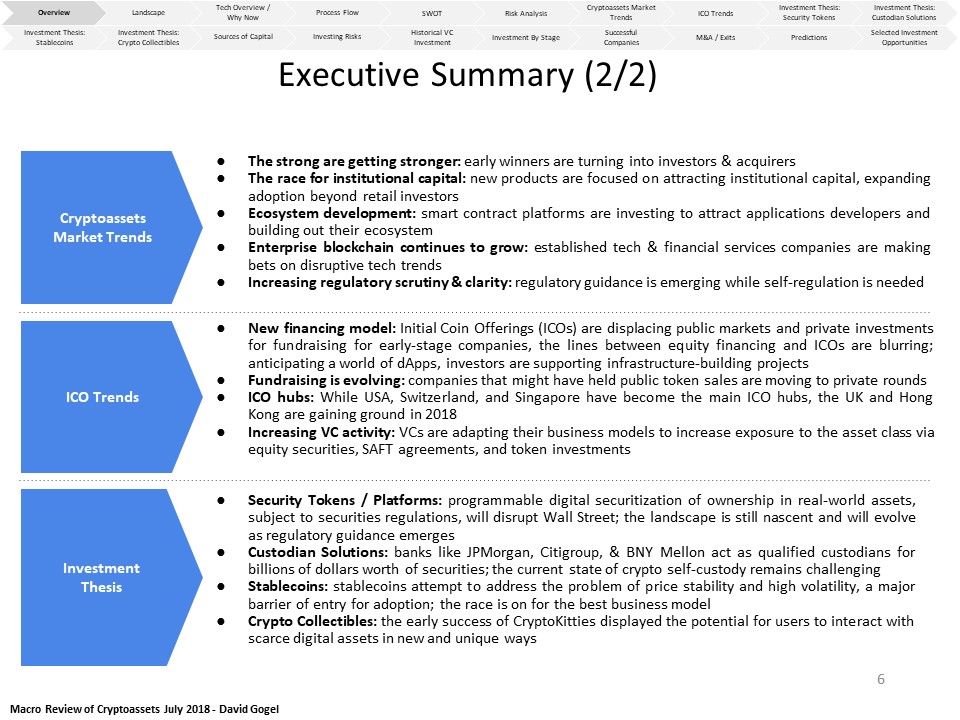

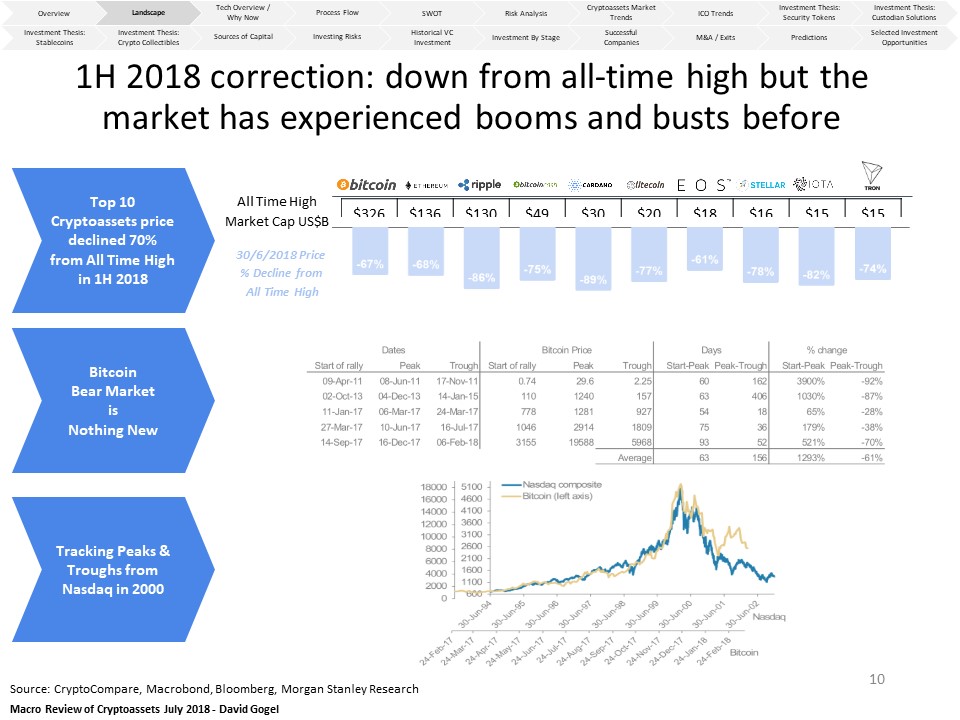

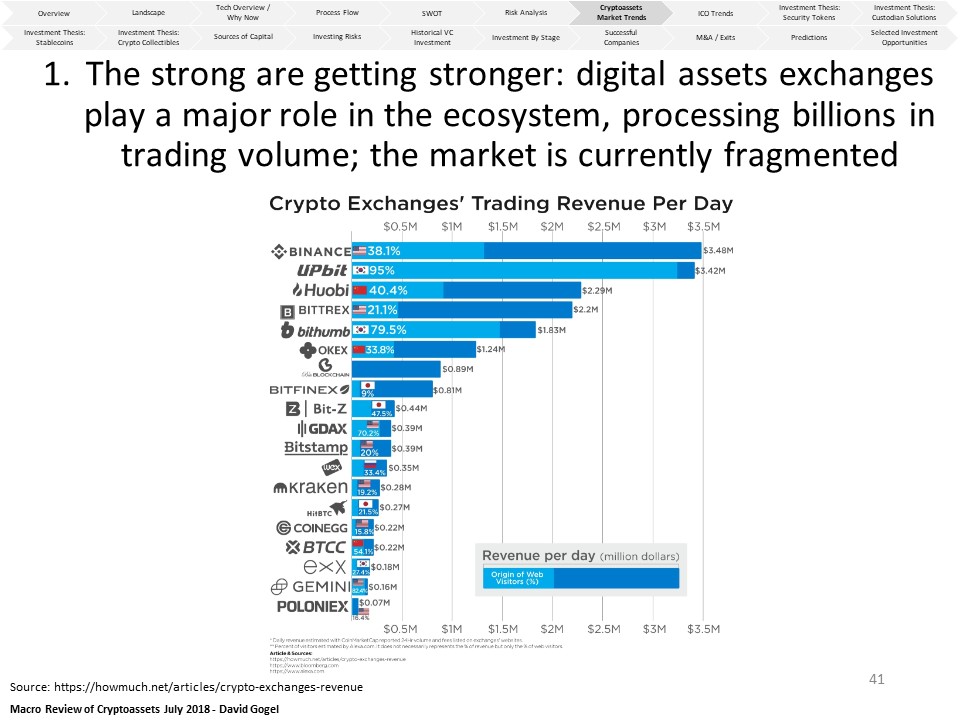

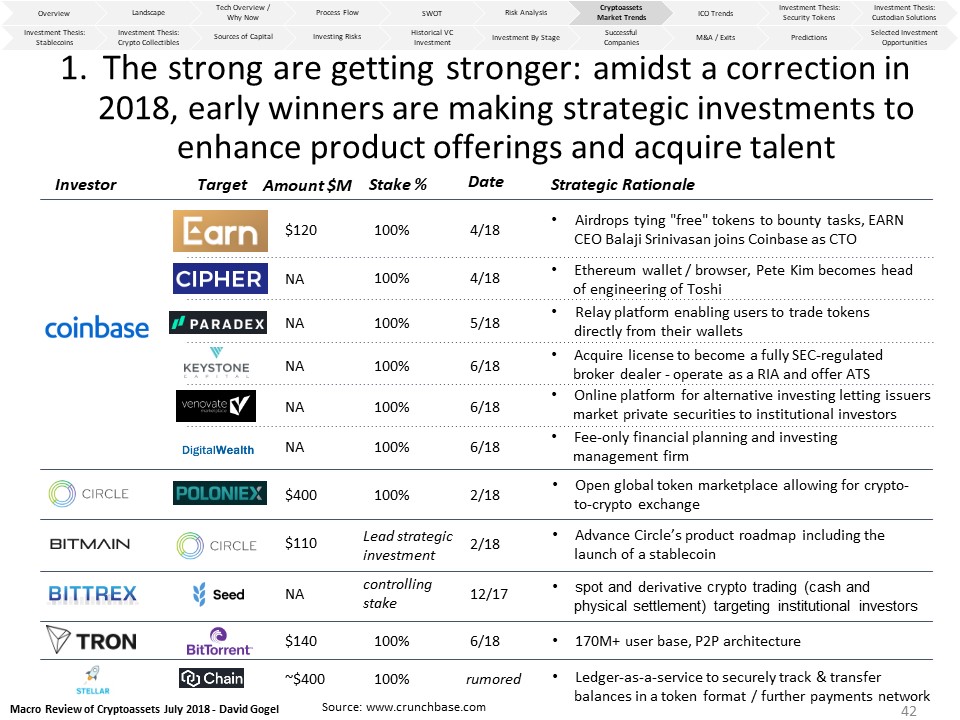

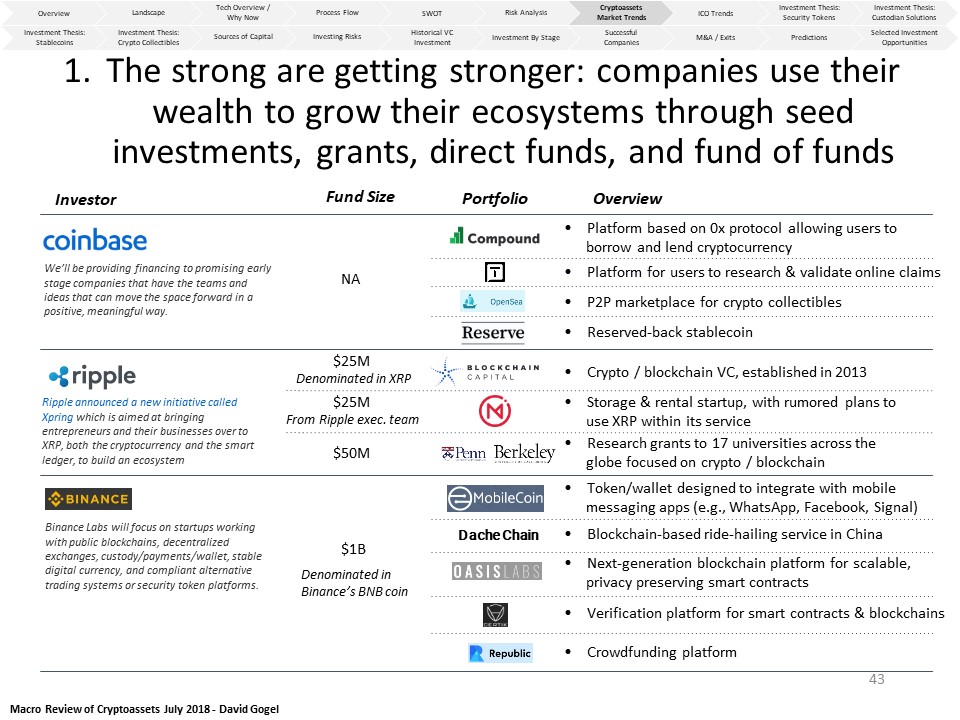

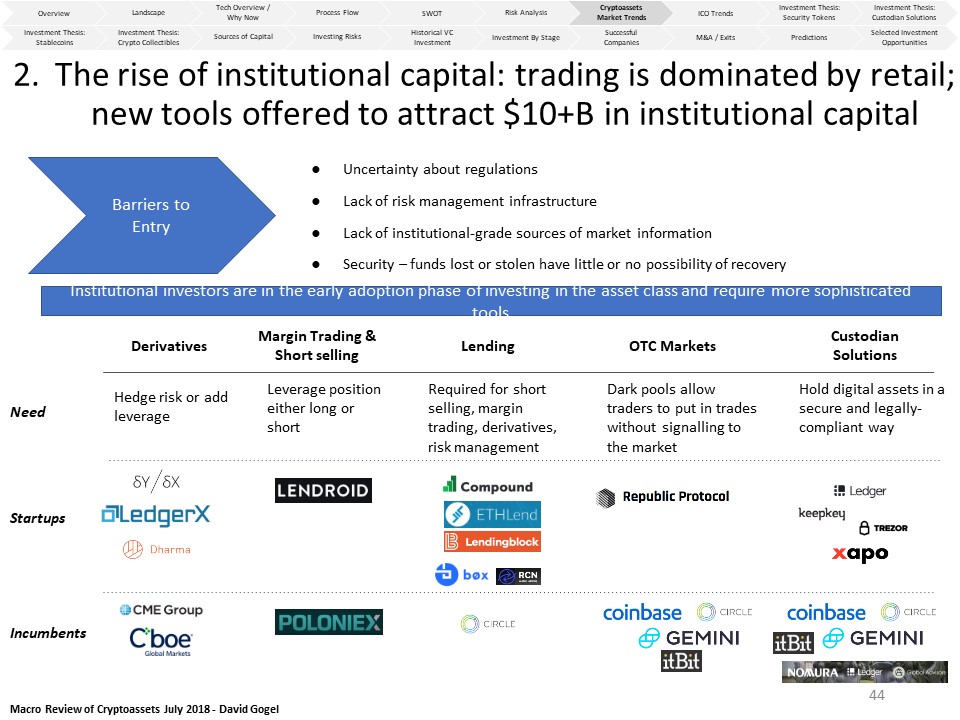

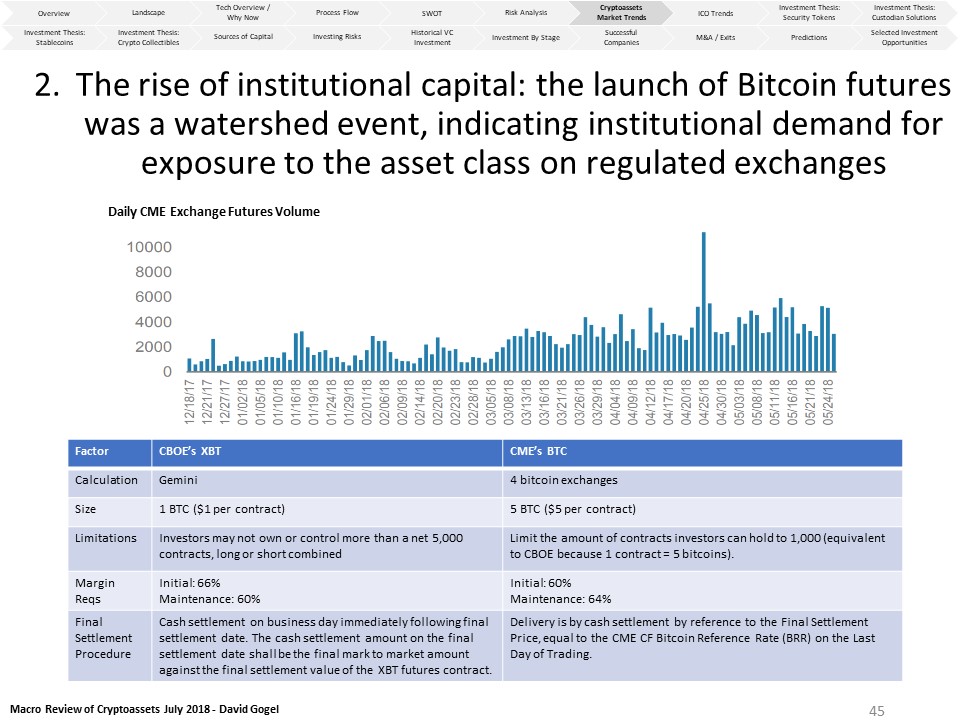

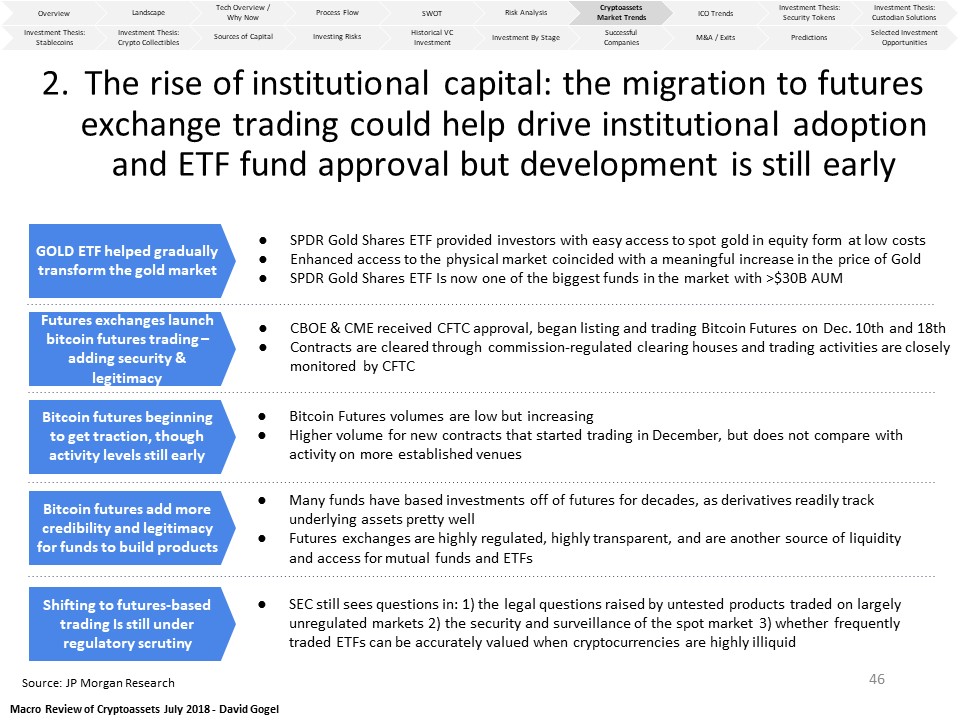

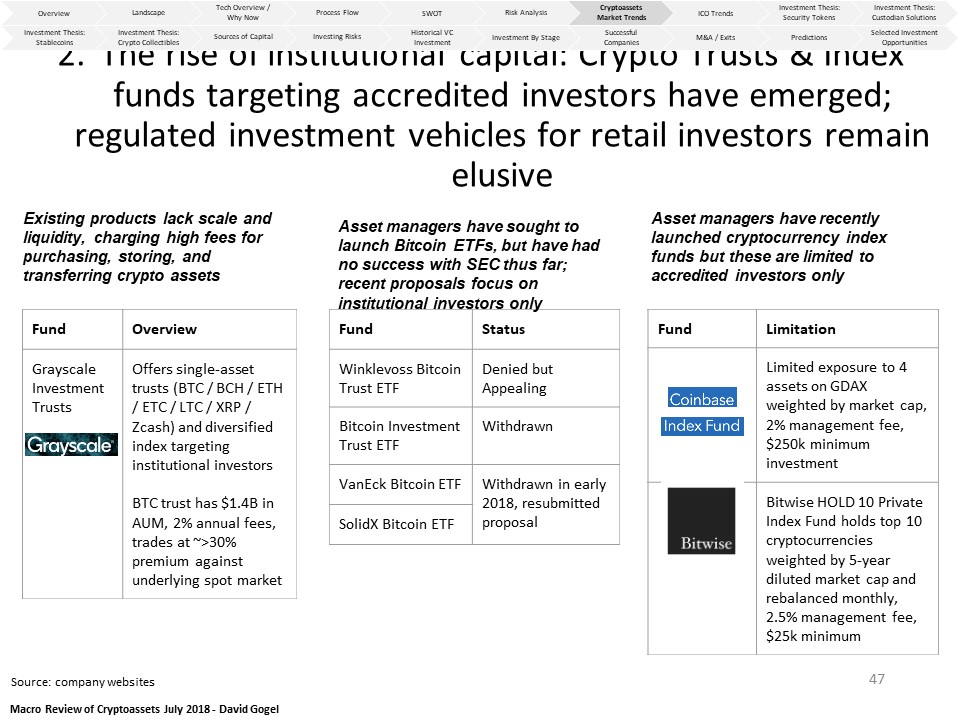

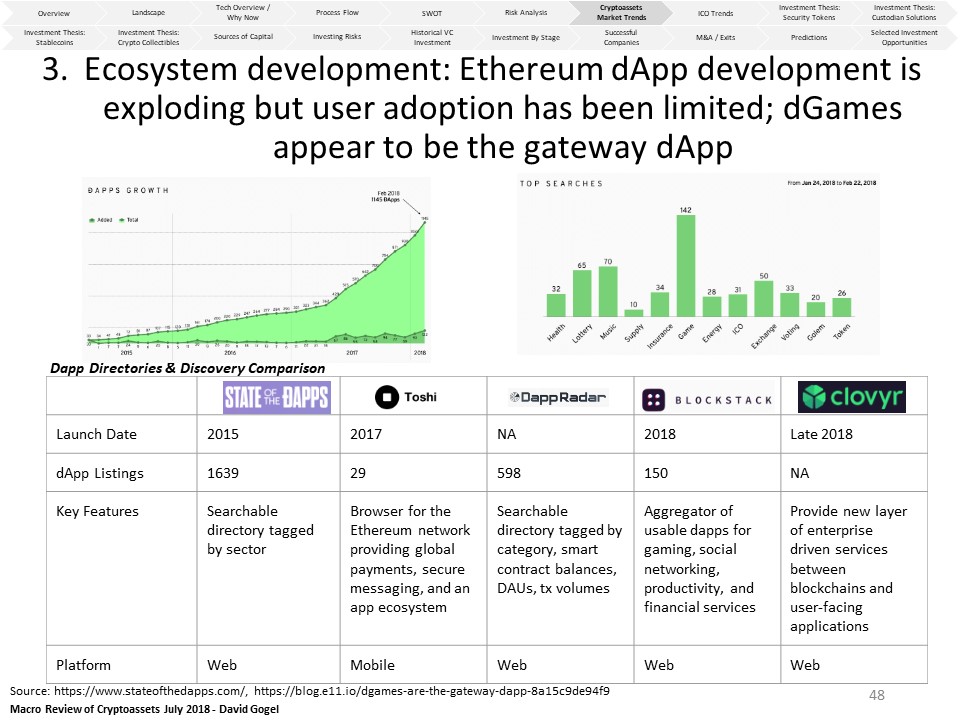

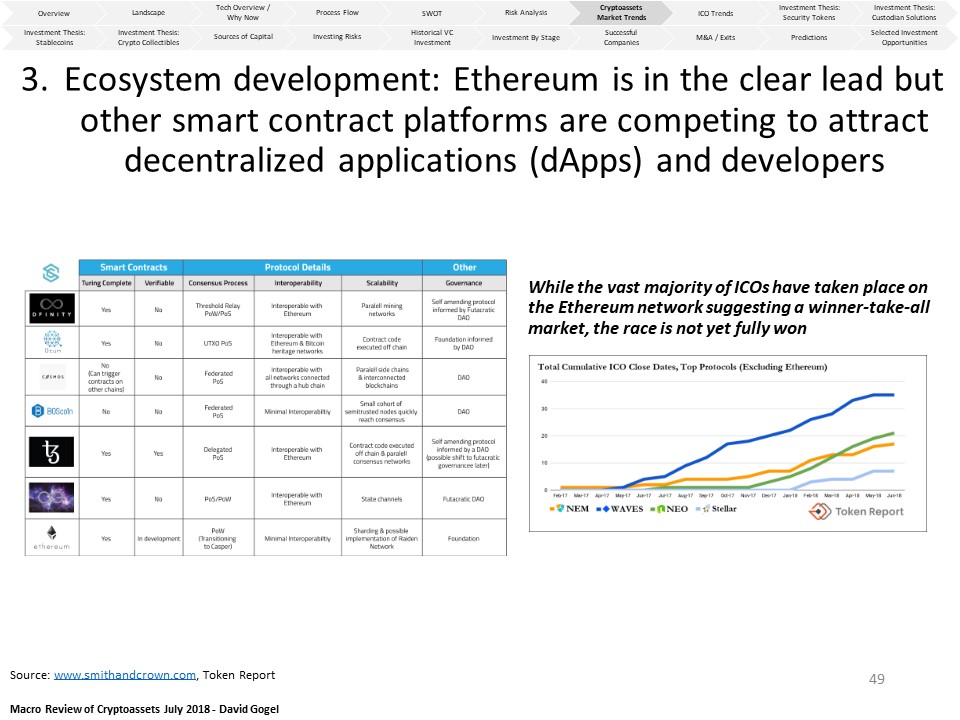

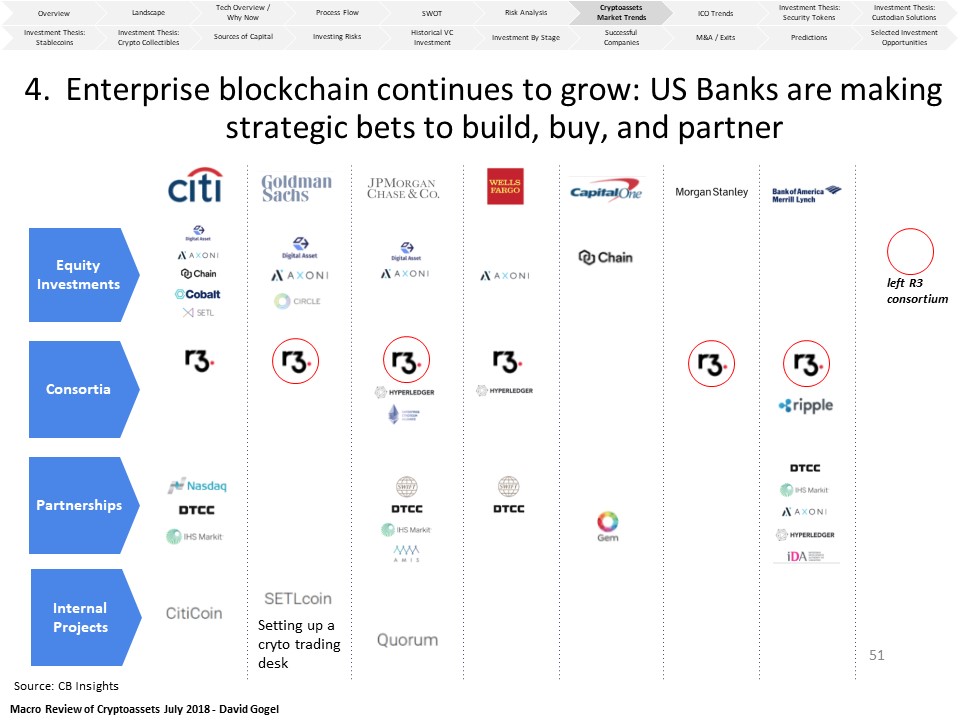

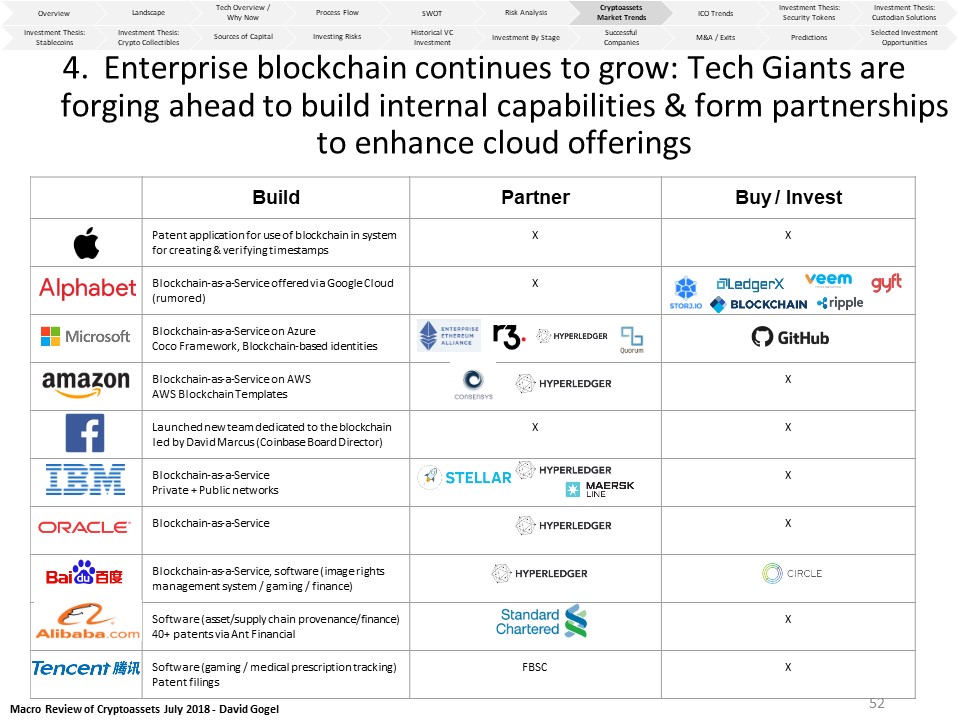

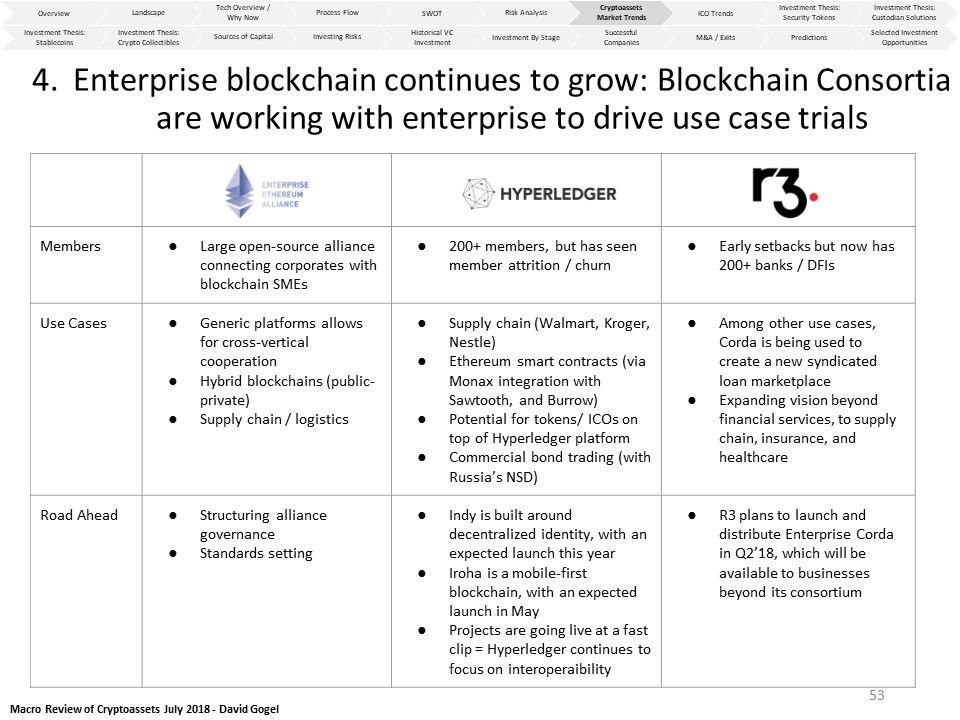

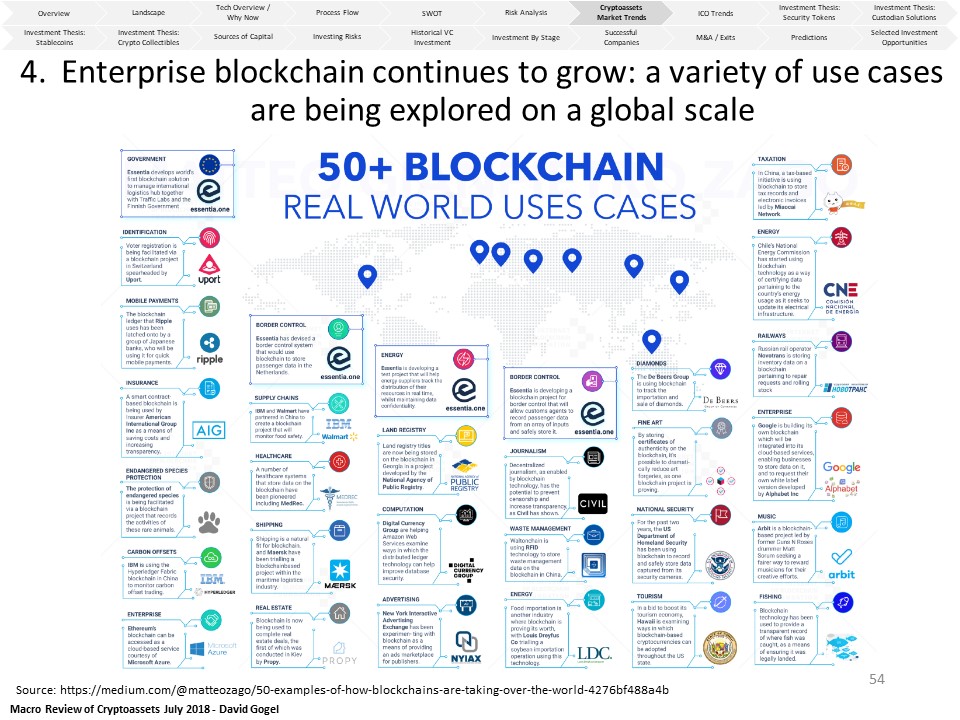

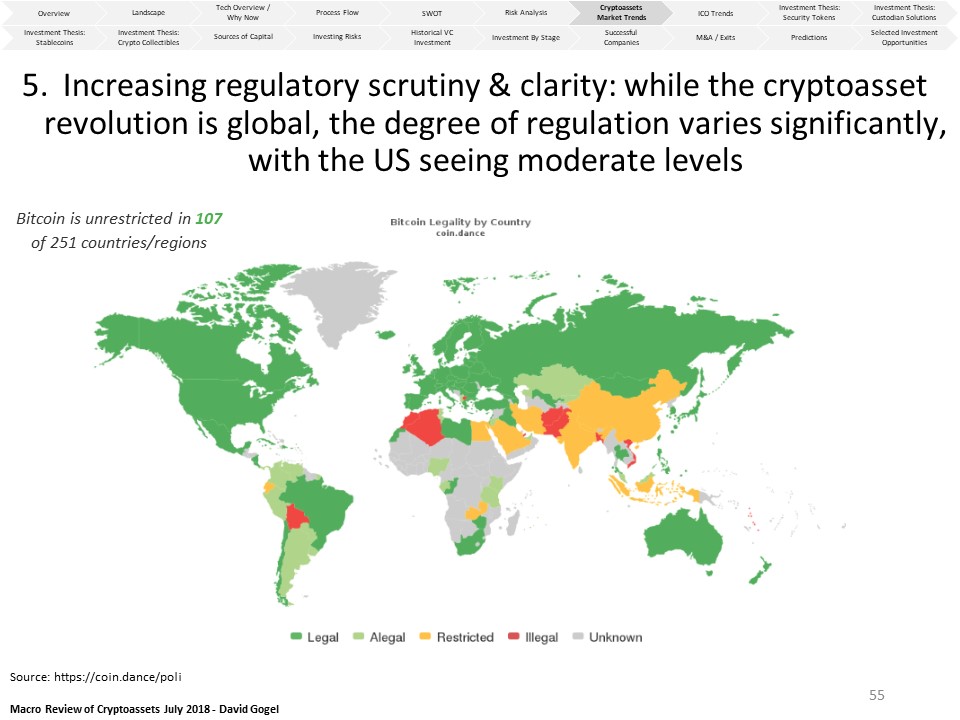

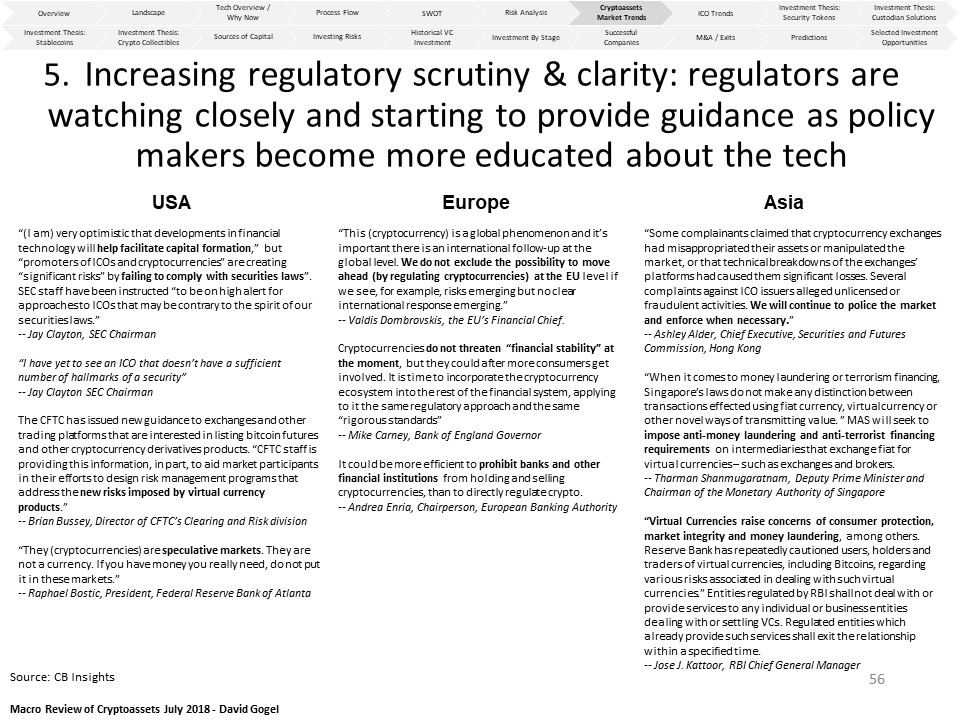

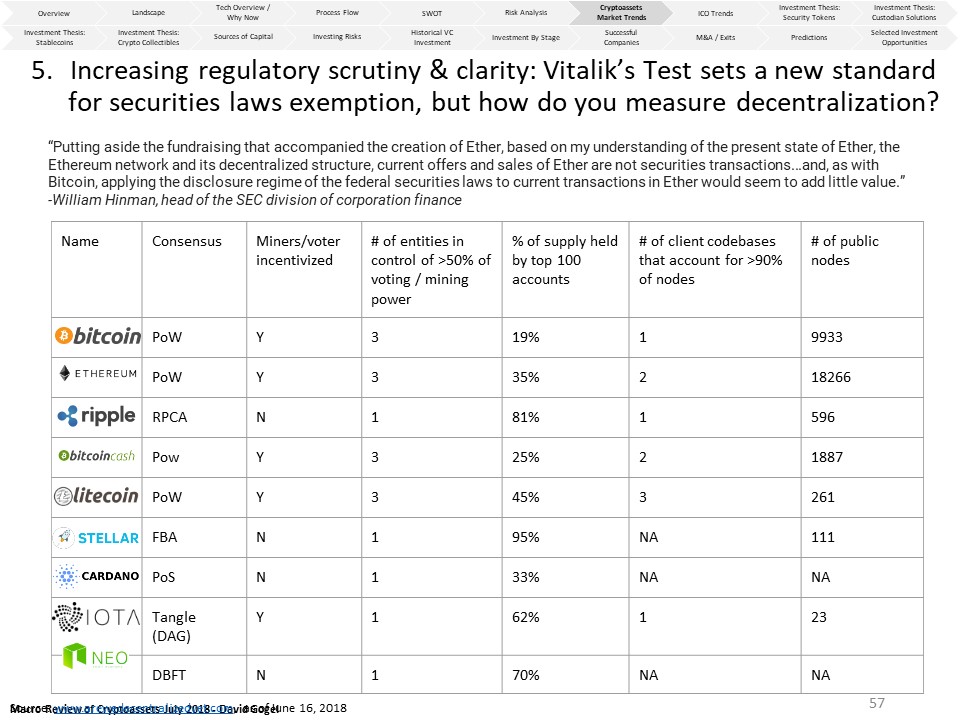

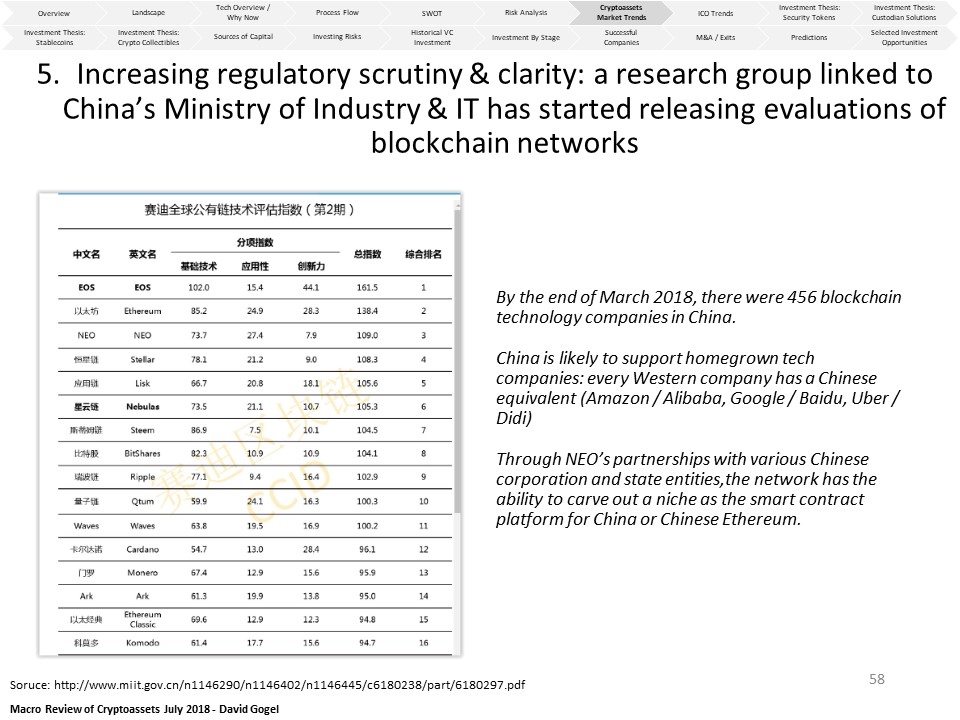

Crypto-assets Market Trends

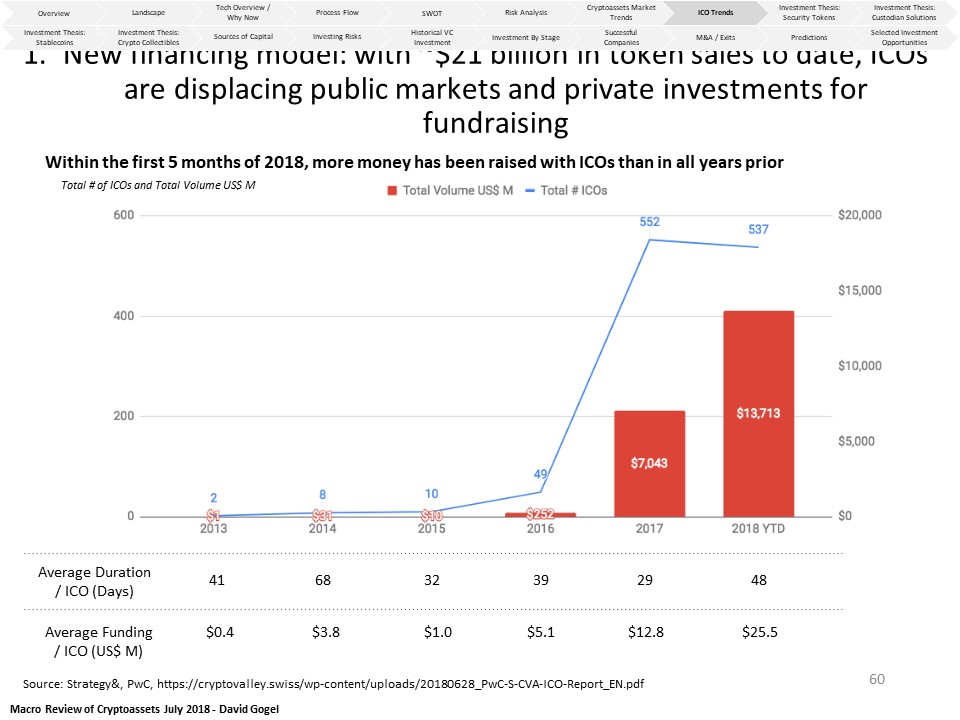

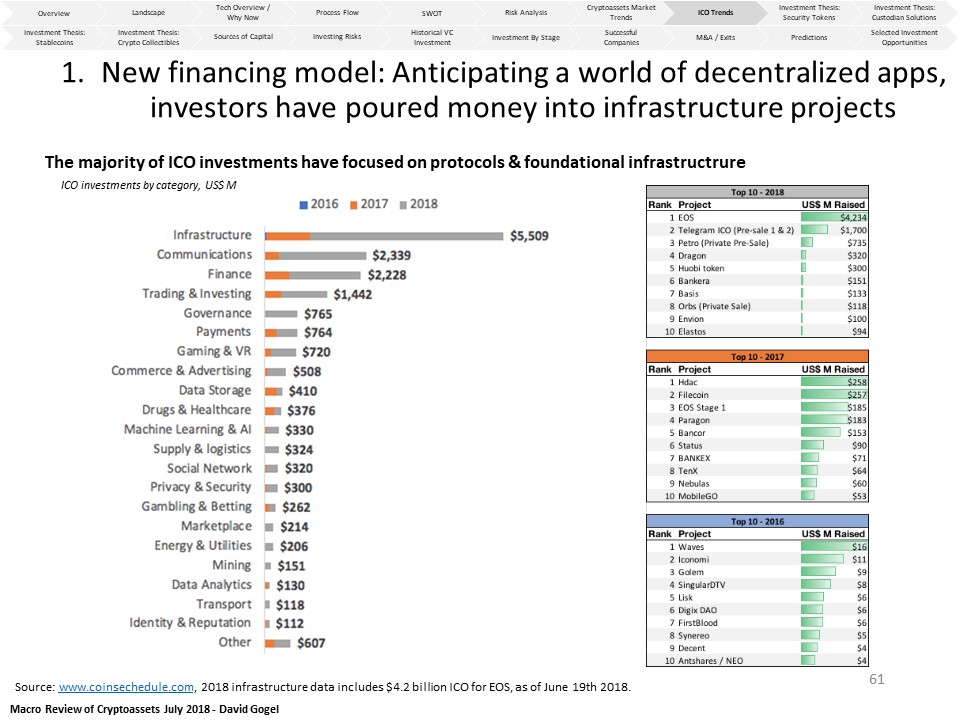

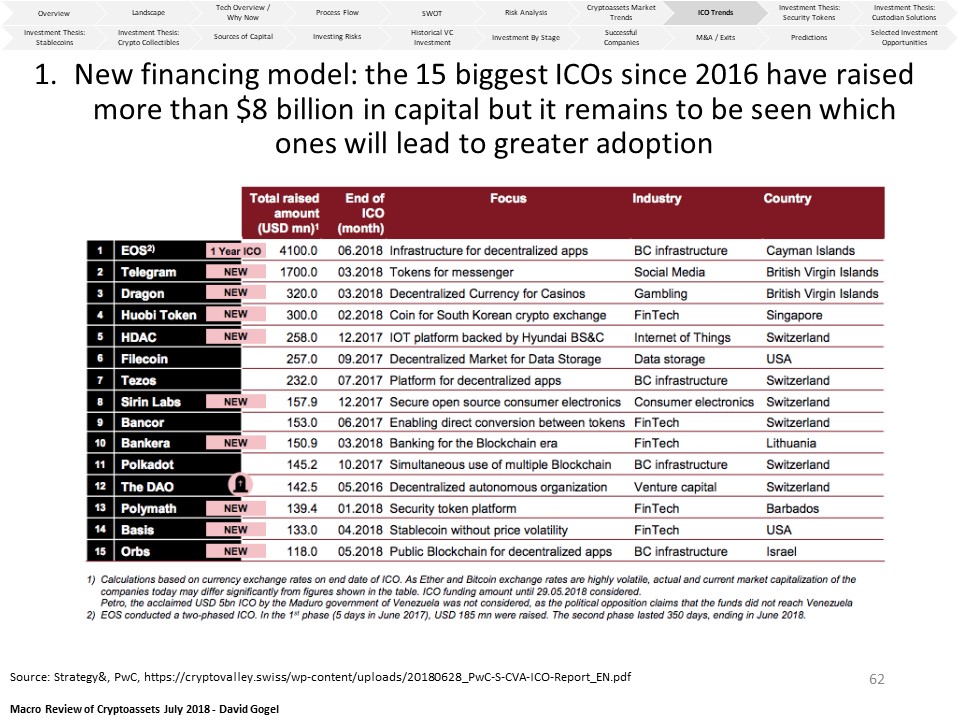

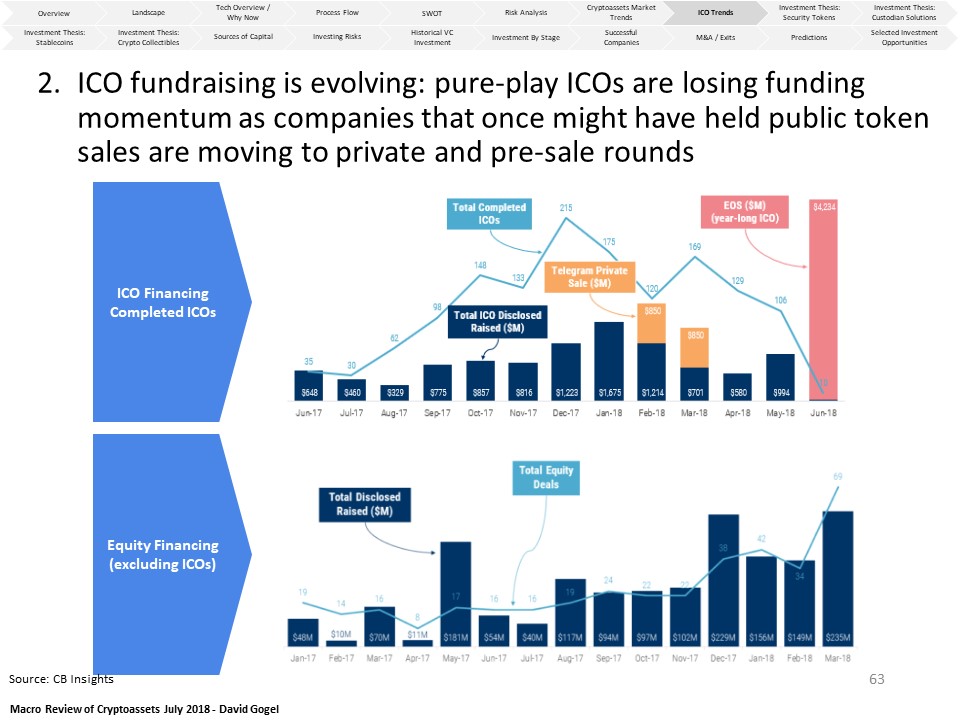

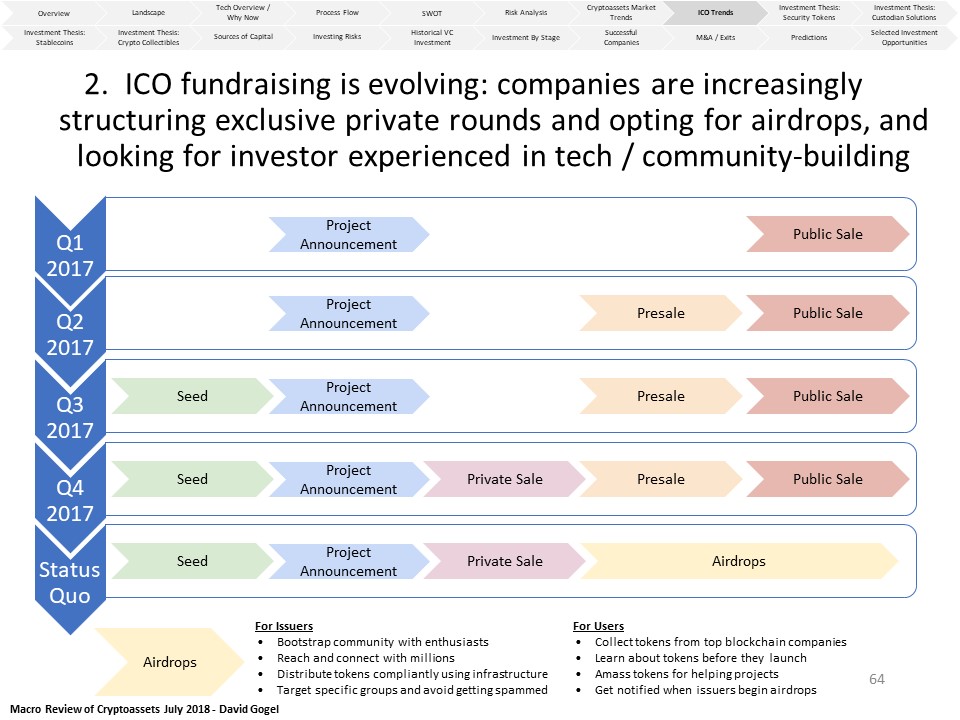

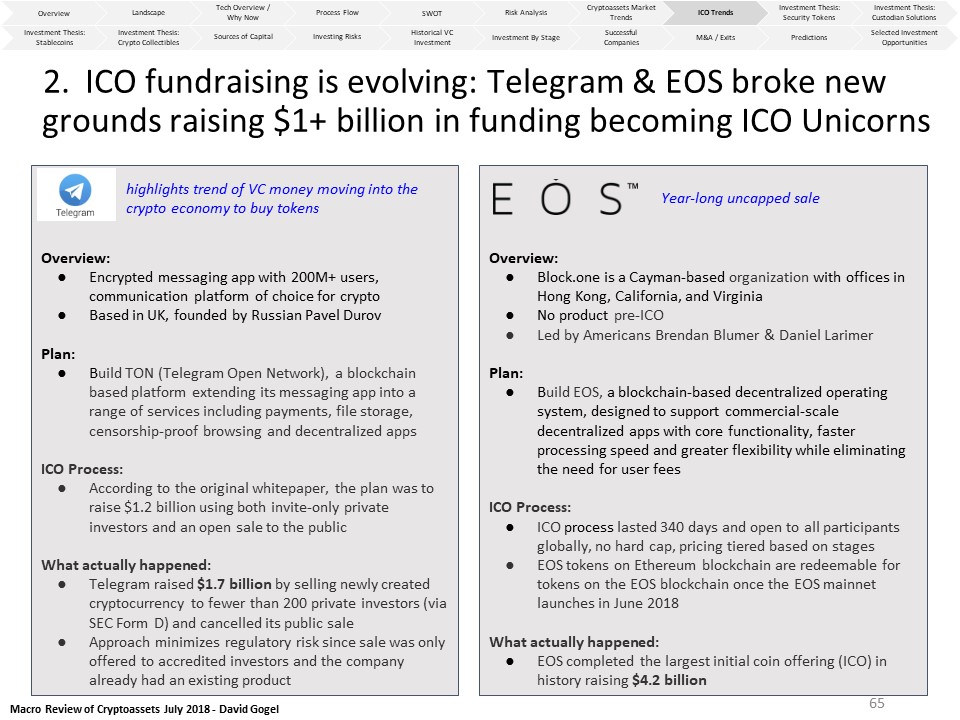

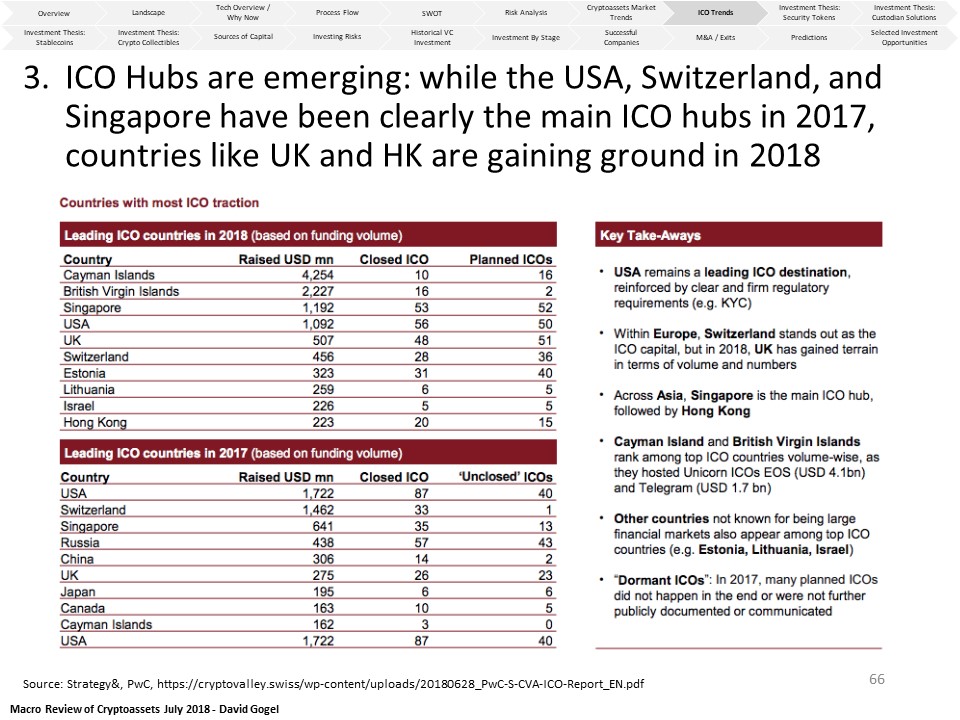

ICO Trends

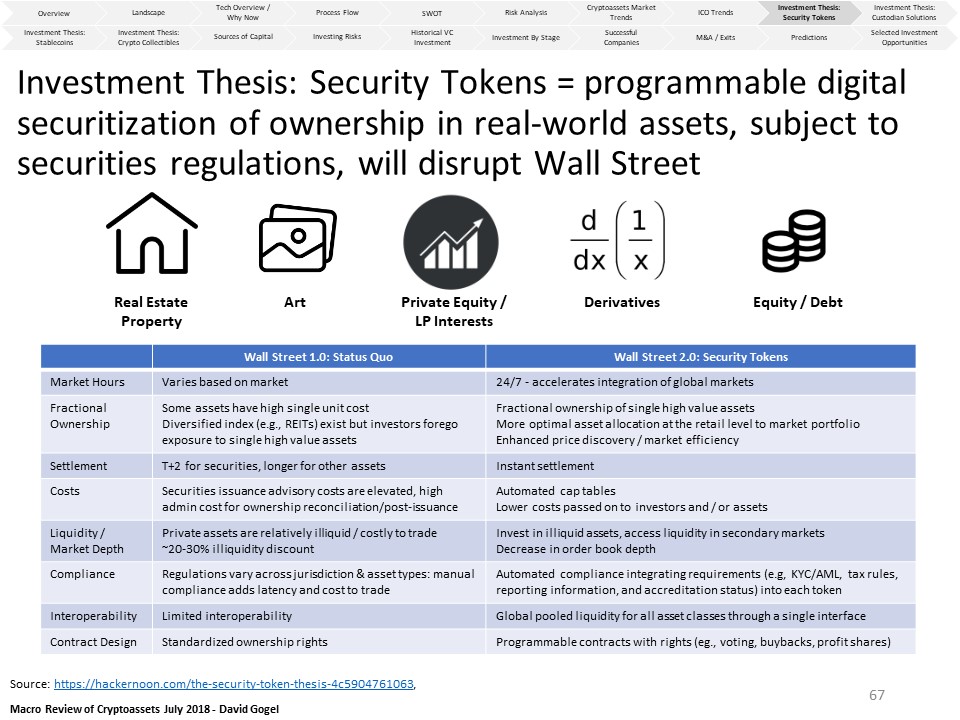

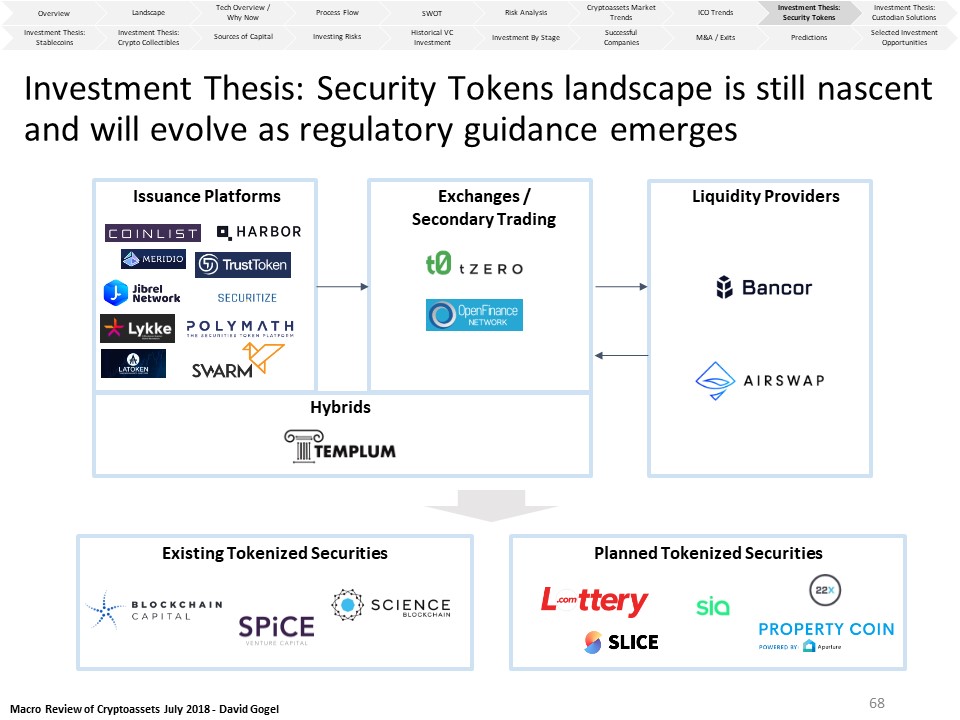

Investment Thesis: Security Tokens

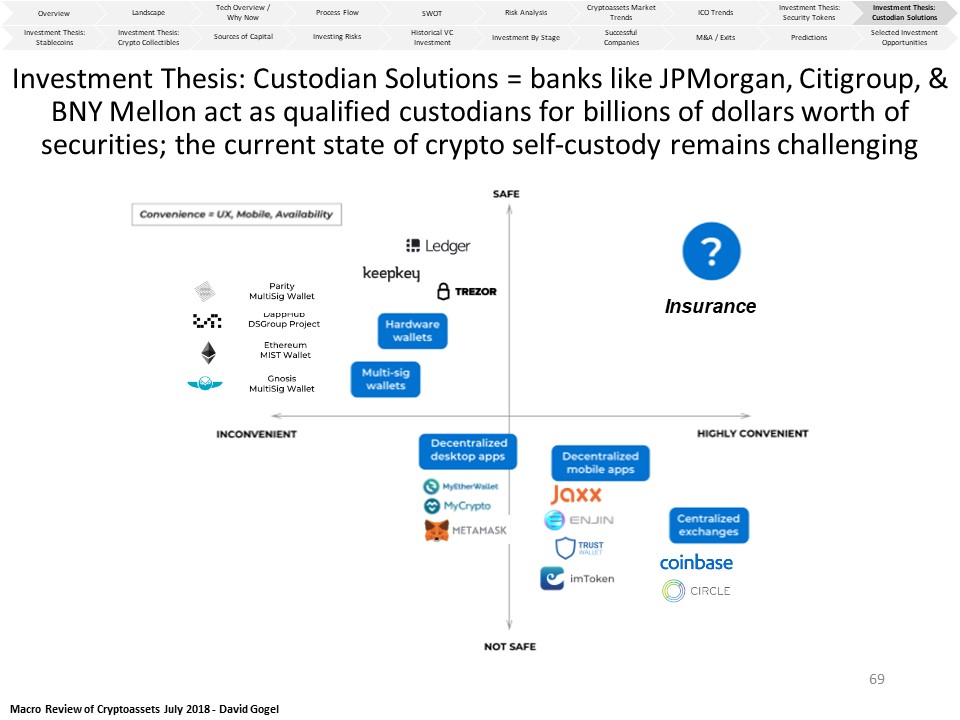

Investment Thesis: Custodian Solutions

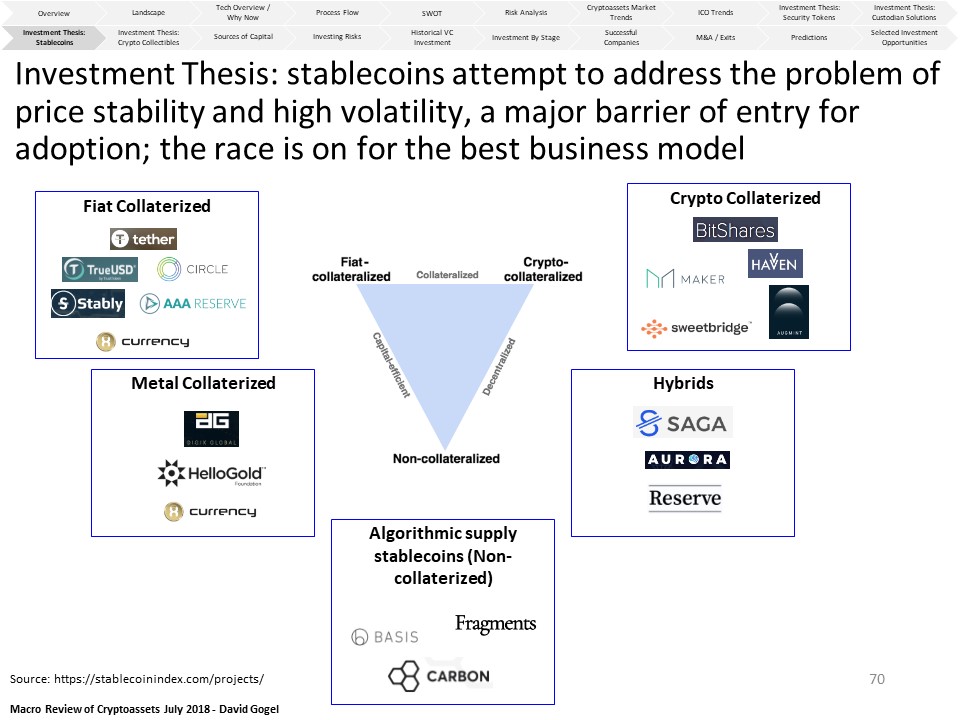

Investment Thesis: Stablecoins

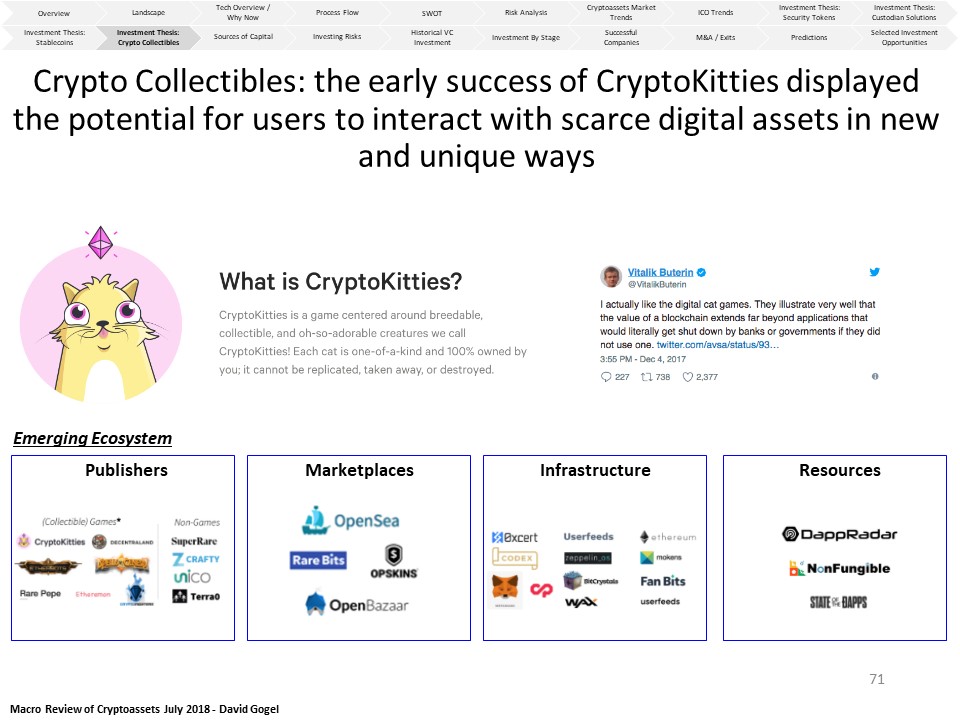

Investment Thesis: Crypto Collectibles

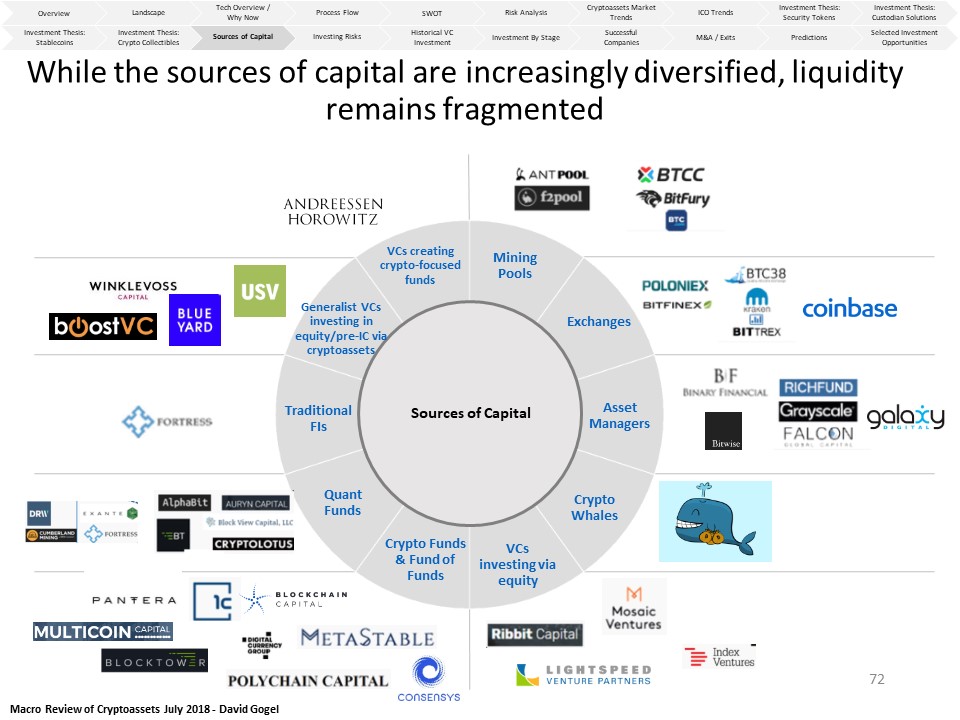

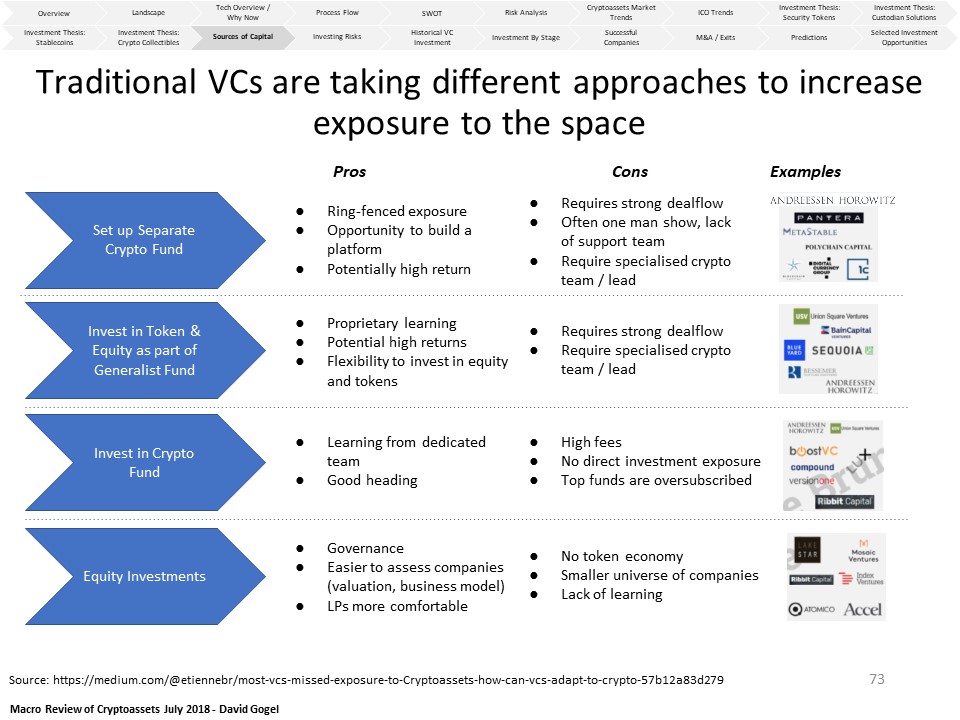

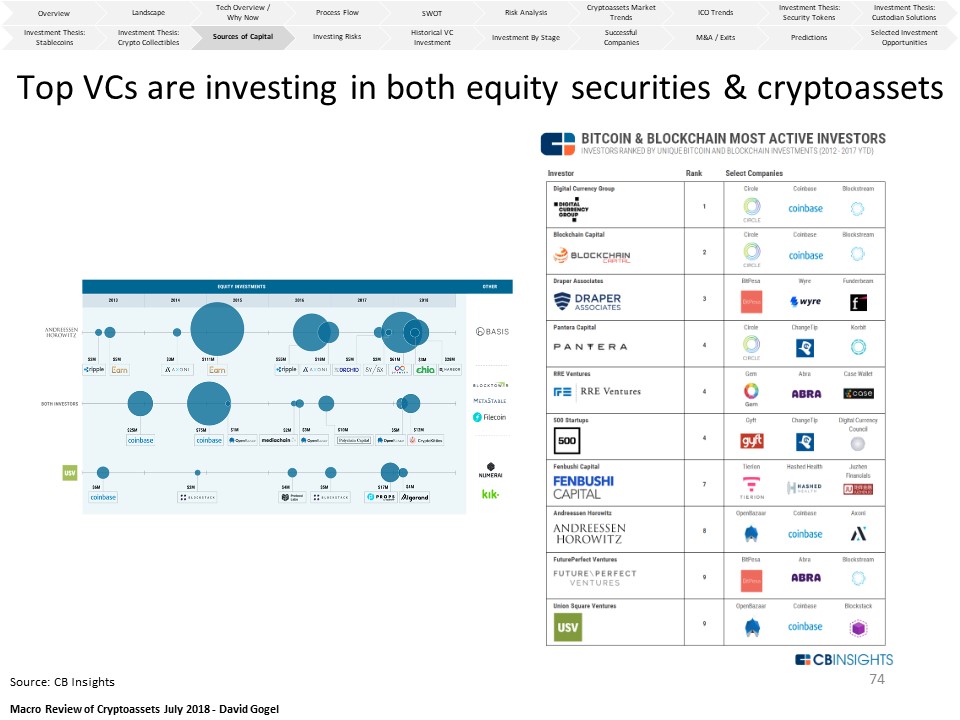

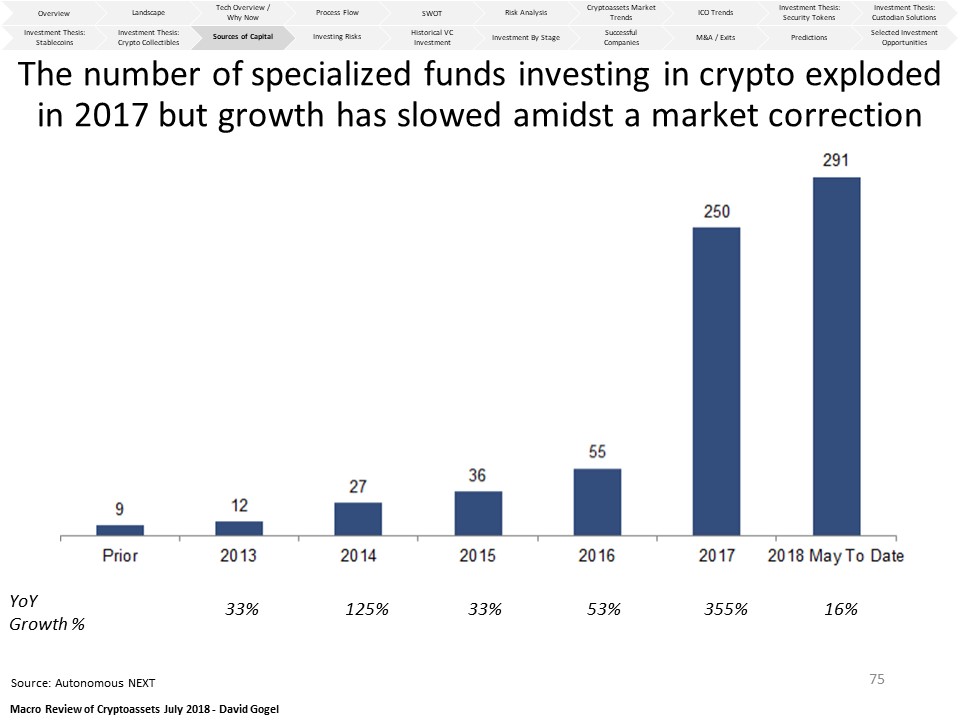

Sources of Capital

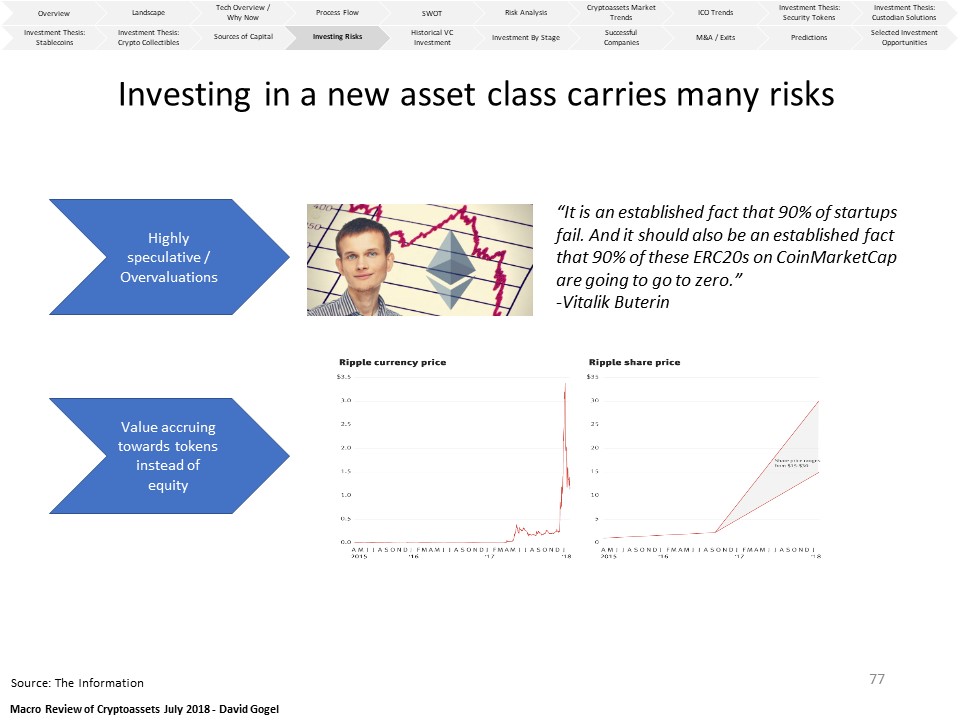

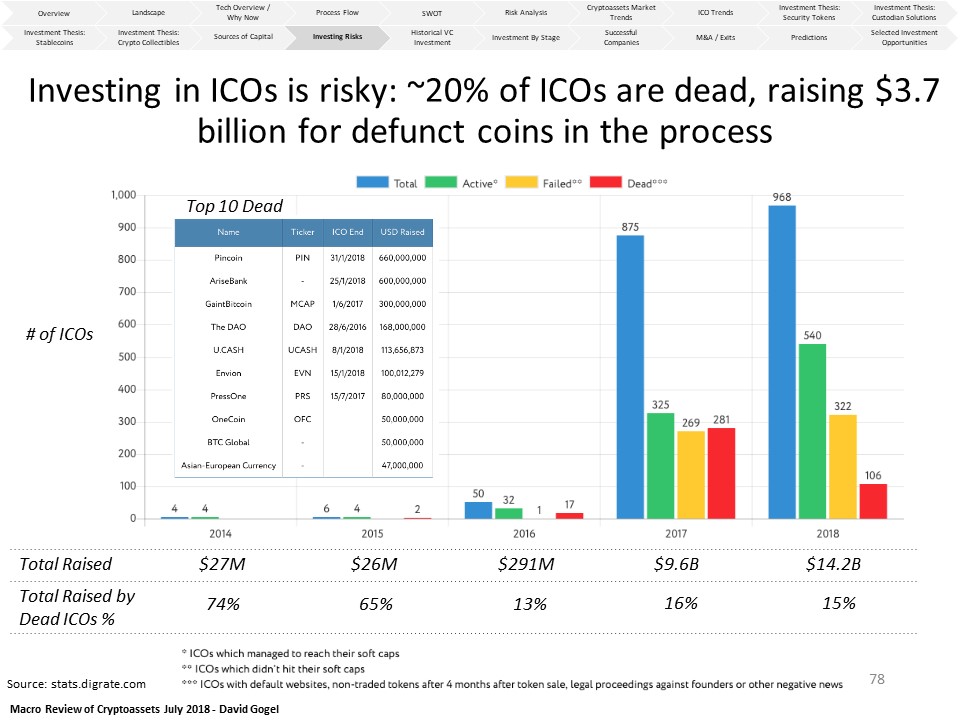

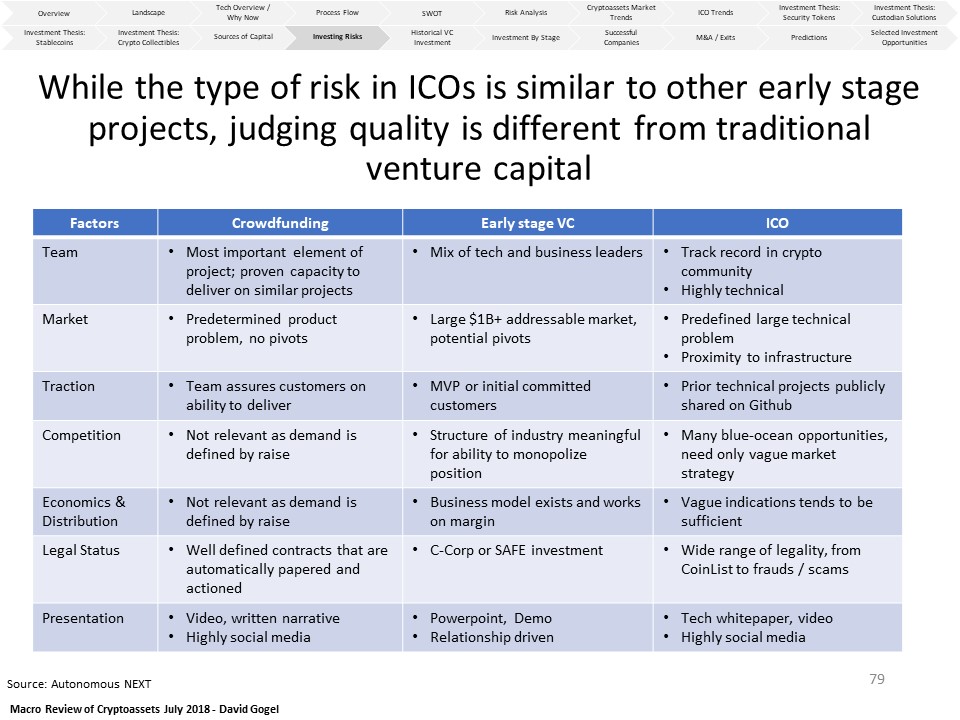

Investing Risks

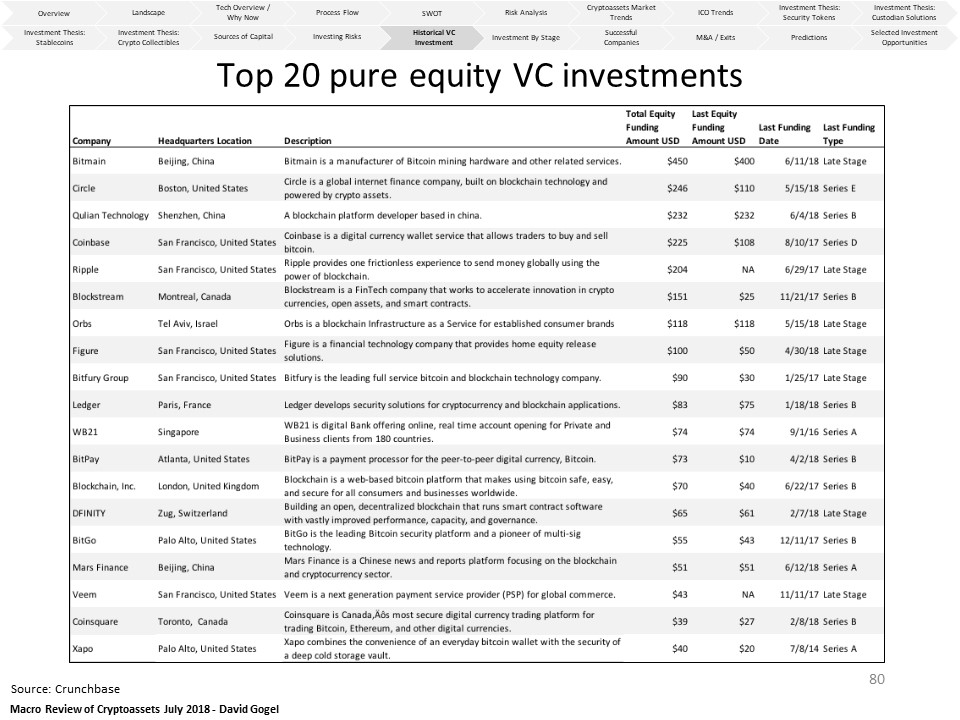

Historical VC Investment

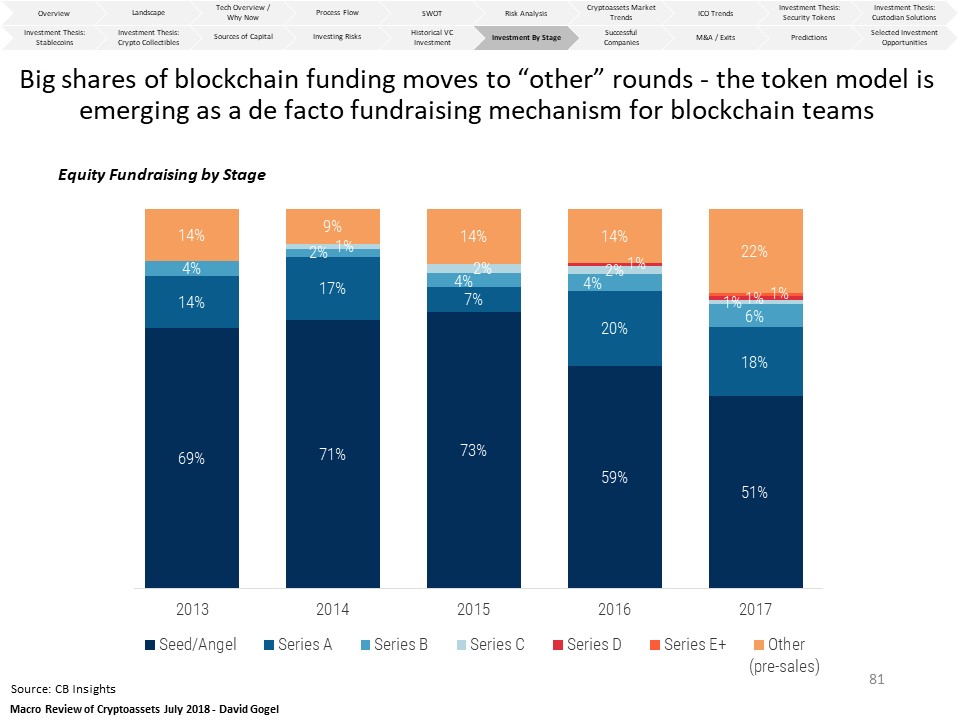

Investment By Stage in the Space

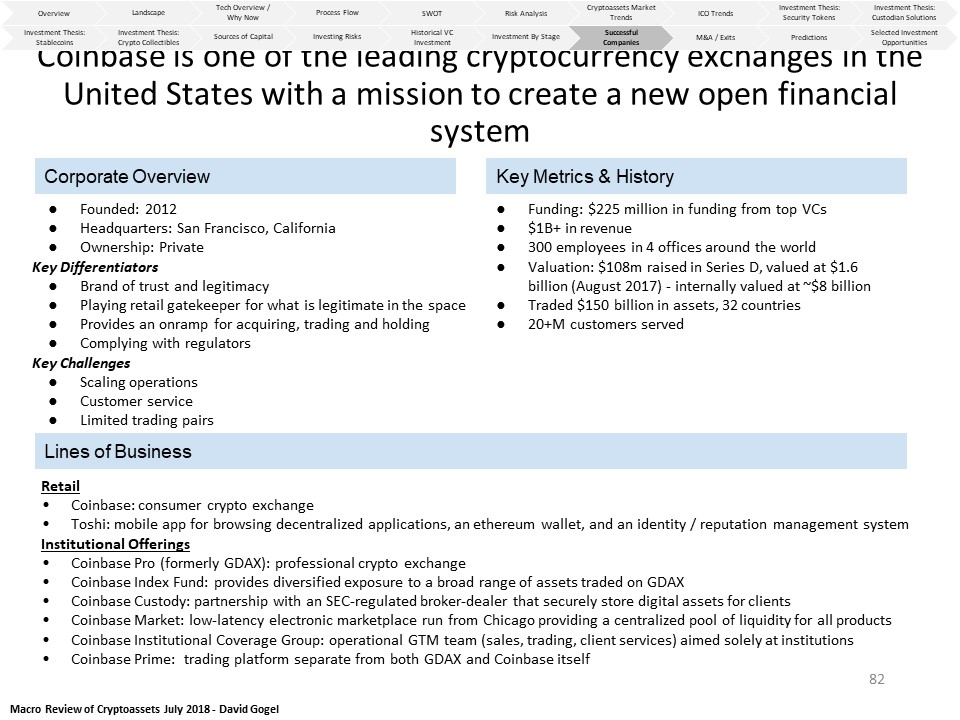

Successful Companies

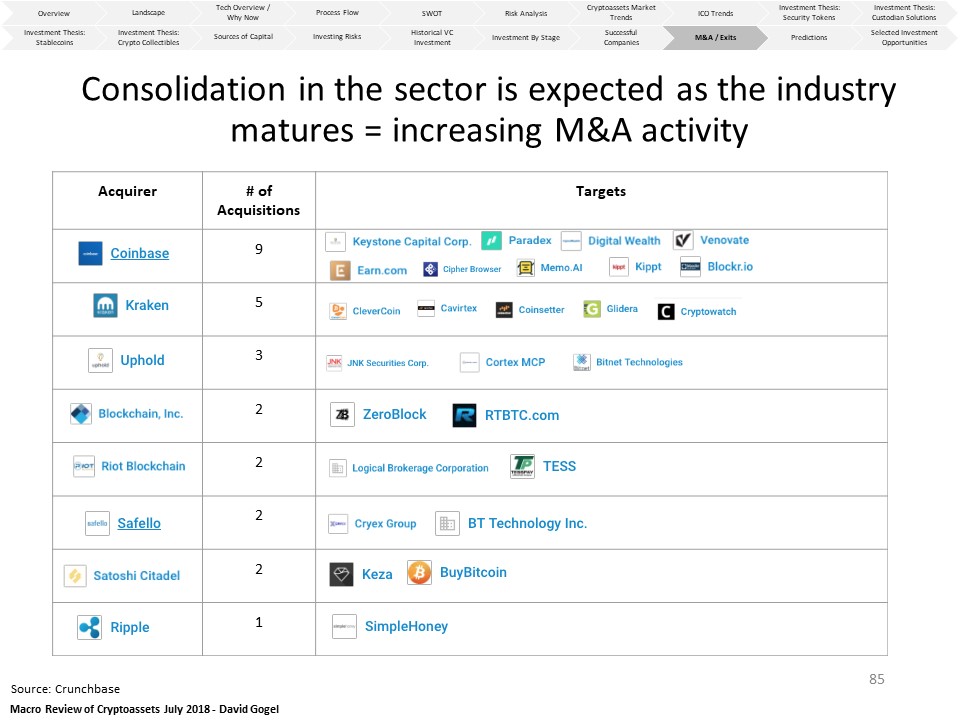

M&A / Exits

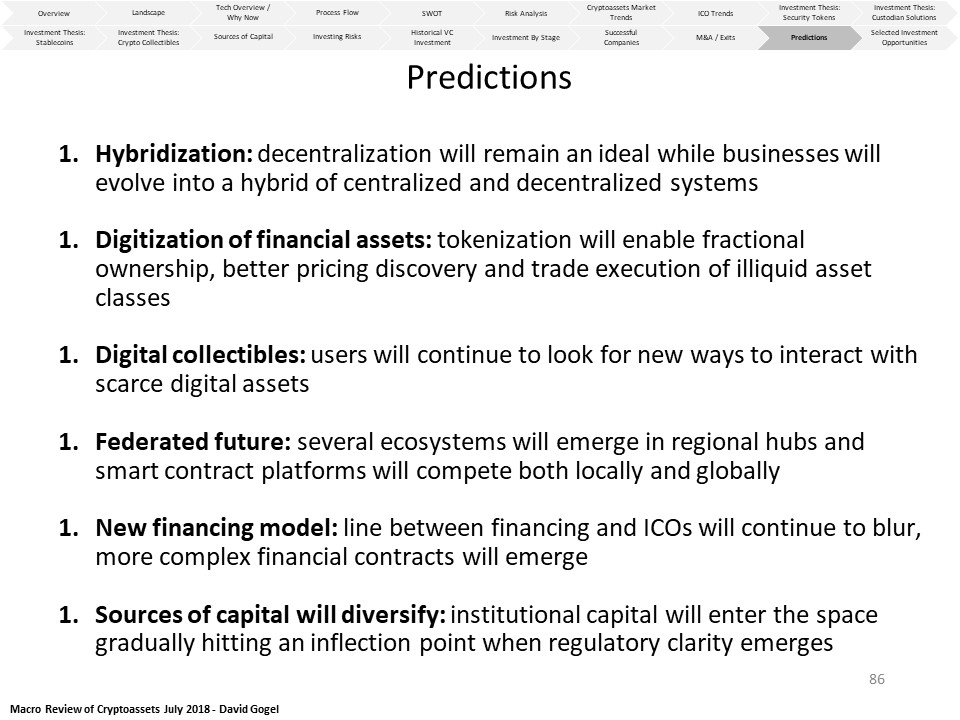

Predictions

Selected Investment Opportunities

Please provide feedback, questions, or corrections: https://goo.gl/forms/whEoeFH6KPR0UWbG2